The bread and butter of economics is demand and supply. The basic idea of a demand function (or a demand curve) is to describe a relationship between the price at which a given product, commodity or service can be bought and the quantity that will bought by some individual. The standard assumption is that the quantity demanded increases as the price falls, so that the demand curve is downward-sloping, but not much more can be said about the shape of a demand curve unless special assumptions are made about the individual’s preferences.

Demand curves aren’t natural phenomena with concrete existence; they are hypothetical or notional constructs pertaining to individual preferences. To pass from individual demands to a market demand for a product, commodity or service requires another conceptual process summing the quantities demanded by each individual at any given price. The conceptual process is never actually performed, so the downward-sloping market demand curve is just presumed, not observed as a fact of nature.

The summation process required to pass from individual demands to a market demand implies that the quantity demanded at any price is the quantity demanded when each individual pays exactly the same price that every other demander pays. At a price of $10/widget, the widget demand curve tells us how many widgets would be purchased if every purchaser in the market can buy as much as desired at $10/widget. If some customers can buy at $10/widget while others have to pay $20/widget or some can’t buy any widgets at any price, then the quantity of widgets actually bought will not equal the quantity on the hypothetical widget demand curve corresponding to $10/widget.

Similar reasoning underlies the supply function or supply curve for any product, commodity or service. The market supply curve is built up from the preferences and costs of individuals and firms and represents the amount of a product, commodity or service that would be willing to offer for sale at different prices. The market supply curve is the result of a conceptual summation process that adds up the amounts that would be hypothetically be offered for sale by every agent at different prices.

The point of this pedantry is to emphasize the that the demand and supply curves we use are drawn on the assumption that a single uniform market price prevails in every market and that all demanders and suppliers can trade without limit at those prices and their trading plans are fully executed. This is the equilibrium paradigm underlying the supply-demand analysis of econ 101.

Economists quite unself-consciously deploy supply-demand concepts to analyze labor markets in a variety of settings. Sometimes, if the labor market under analysis is limited to a particular trade or a particular skill or a particular geographic area, the supply-demand framework is reasonable and appropriate. But when applied to the aggregate labor market of the whole economy, the supply-demand framework is inappropriate, because the ceteris-paribus proviso (all prices other than the price of the product, commodity or service in question are held constant) attached to every supply-demand model is obviously violated.

Thoughtlessly applying a simple supply-demand model to analyze the labor market of an entire economy leads to the conclusion that widespread unemployment, when some workers are unemployed, but would have accepted employment offers at wages that comparably skilled workers are actually receiving, implies that wages are above the market-clearing wage level consistent with full employment.

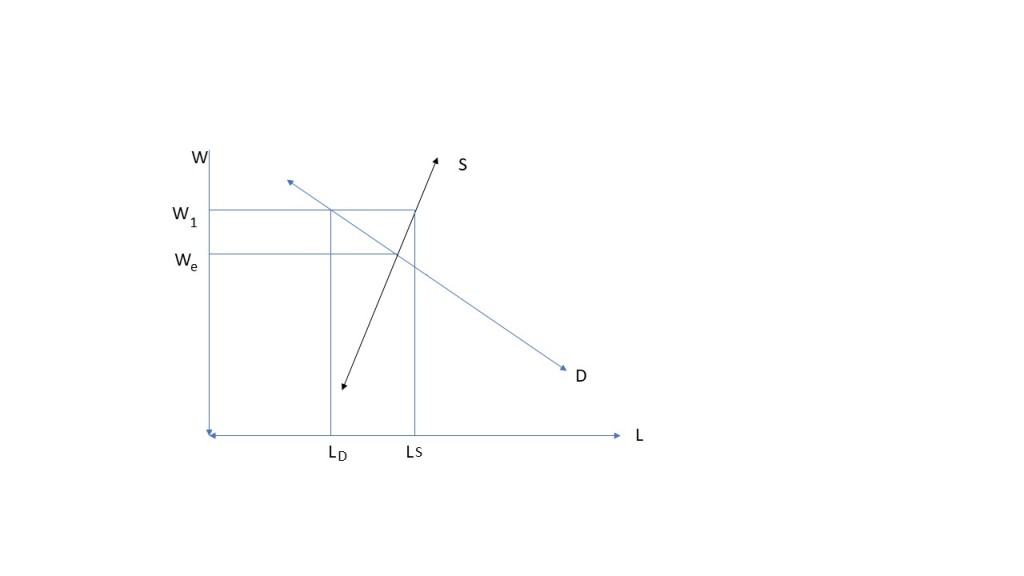

The attached diagram for simplest version of this analysis. The market wage (W1) is higher than the equilibrium wage (We) at which all workers willing to accept that wage could be employed. The difference between the number of workers seeking employment at the market wage (LS) and the number of workers that employers seek to hire (LD) measures the amount of unemployment. According to this analysis, unemployment would be eliminated if the market wage fell from W1 to We.

Applying supply-demand analysis to aggregate unemployment fails on two levels. First, workers clearly are unable to execute their plans to offer their labor services at the wage at which other workers are employed, so individual workers are off their supply curves. Second, it is impossible to assume, supply-demand analysis requires, that all other prices and incomes remain constant so that the demand and supply curves do not move as wages and employment change. When multiple variables are mutually interdependent and simultaneously determined, the analysis of just two variables (wages and employment) cannot be isolated from the rest of the system. Focusing on the wage as the variable that needs to change to restore full employment is an example of the tunnel vision.

Keynes rejected the idea that economy-wide unemployment could be eliminated by cutting wages. Although Keynes’s argument against wage cuts as a cure for unemployment was flawed, he did have at least an intuitive grasp of the basic weakness in the argument for wage cuts: that high aggregate unemployment is not usefully analyzed as a symptom of excessive wages. To explain why wage cuts aren’t the cure for high unemployment, Keynes introduced a distinction between voluntary and involuntary unemployment.

Forty years later, Robert Lucas began his effort — not the first such effort, but by far the most successful — to discredit the concept of involuntary unemployment. Here’s an early example:

Keynes [hypothesized] that measured unemployment can be decomposed into two distinct components: ‘voluntary’ (or frictional) and ‘involuntary’, with full employment then identified as the level prevailing when involuntary employment equals zero. It seems appropriate, then, to begin by reviewing Keynes’ reasons for introducing this distinction in the first place. . . .

Accepting the necessity of a distinction between explanations for normal and cyclical unemployment does not, however, compel one to identify the first as voluntary and the second as involuntary, as Keynes goes on to do. This terminology suggests that the key to the distinction lies in some difference in the way two different types of unemployment are perceived by workers. Now in the first place, the distinction we are after concerns sources of unemployment, not differentiated types. . . .[O]ne may classify motives for holding money without imagining that anyone can subdivide his own cash holdings into “transactions balances,” “precautionary balances”, and so forth. The recognition that one needs to distinguish among sources of unemployment does not in any way imply that one needs to distinguish among types.

Nor is there any evident reason why one would want to draw this distinction. Certainly the more one thinks about the decision problem facing individual workers and firms the less sense this distinction makes. The worker who loses a good job in prosperous time does not volunteer to be in this situation: he has suffered a capital loss. Similarly, the firm which loses an experienced employee in depressed times suffers an undesirable capital loss. Nevertheless, the unemployed worker at any time can always find some job at once, and a firm can always fill a vacancy instantaneously. That neither typically does so by choice is not difficult to understand given the quality of the jobs and the employees which are easiest to find. Thus there is an involuntary element in all unemployment, in the sense that no one chooses bad luck over good; there is also a voluntary element in all unemployment, in the sense that however miserable one’s current work options, one can always choose to accept them.

Lucas, Studies in Business Cycle Theory, pp. 241-43

Consider this revision of Lucas’s argument:

The expressway driver who is slowed down in a traffic jam does not volunteer to be in this situation; he has suffered a waste of his time. Nevertheless, the driver can get off the expressway at the next exit to find an alternate route. Thus, there is an involuntary element in every traffic jam, in the sense that no one chooses to waste time; there is also a voluntary element in all traffic jams, in the sense that however stuck one is in traffic, one can always take the next exit on the expressway.

What is lost on Lucas is that, for an individual worker, taking a wage cut to avoid being laid off by the employer accomplishes nothing, because the willingness of a single worker to accept a wage cut would not induce the employer to increase output and employment. Unless all workers agreed to take wage cuts, a wage cut to one employee would have not cause the employer to reconsider its plan to reduce in the face of declining demand for its product. Only the collective offer of all workers to accept a wage cut would induce an output response by the employer and a decision not to lay off part of its work force.

But even a collective offer by all workers to accept a wage cut would be unlikely to avoid an output reduction and layoffs. Consider a simple case in which the demand for the employer’s output declines by a third. Suppose the employer’s marginal cost of output is half the selling price (implying a demand elasticity of -2). Assume that demand is linear. With no change in its marginal cost, the firm would reduce output by a third, presumably laying off up to a third of its employees. Could workers avoid the layoffs by accepting lower wages to enable the firm to reduce its price? Or asked in another way, how much would marginal cost have to fall for the firm not to reduce output after the demand reduction?

Working out the algebra, one finds that for the firm to keep producing as much after a one-third reduction in demand, the firm’s marginal cost would have to fall by two-thirds, a decline that could only be achieved by a radical reduction in labor costs. This is surely an oversimplified view of the alternatives available to workers and employers, but the point is that workers facing a layoff after the demand for the product they produce have almost no ability to remain employed even by collectively accepting a wage cut.

That conclusion applies a fortiori when decisions whether to accept a wage cut are left to individual workers, because the willingness of workers individually to accept a wage cut is irrelevant to their chances of retaining their jobs. Being laid off because of decline in the demand for the product a worker is producing is a much different situation from being laid off, because a worker’s employer is shifting to a new technology for which the workers lack the requisite skills, and can remain employed only by accepting re-assignment to a lower-paying job.

Let’s follow Lucas a bit further:

Keynes, in chapter 2, deals with the situation facing an individual unemployed worker by evasion and wordplay only. Sentences like “more labor would, as a rule, be forthcoming at the existing money wage if it were demanded” are used again and again as though, from the point of view of a jobless worker, it is unambiguous what is meant by “the existing money wage.” Unless we define an individual’s wage rate as the price someone else is willing to pay him for his labor (in which case Keynes’s assertion is defined to be false to be false), what is it?

Lucas, Id.

I must admit that, reading this passage again perhaps 30 or more years after my first reading, I’m astonished that I could have once read it without astonishment. Lucas gives the game away by accusing Keynes of engaging in evasion and wordplay before embarking himself on sustained evasion and wordplay. The meaning of the “existing money wage” is hardly ambiguous, it is the money wage the unemployed worker was receiving before losing his job and the wage that his fellow workers, who remain employed, continue to receive.

Is Lucas suggesting that the reason that the worker lost his job while his fellow workers who did not lose theirs is that the value of his marginal product fell but the value of his co-workers’ marginal product did not? Perhaps, but that would only add to my astonishment. At the current wage, employers had to reduce the number of workers until their marginal product was high enough for the employer to continue employing them. That was not necessarily, and certainly not primarily, because some workers were more capable than those that were laid off.

The fact is, I think, that Keynes wanted to get labor markets out of the way in chapter 2 so that he could get on to the demand theory which really interested him.

More wordplay. Is it fact or opinion? Well, he says that thinks it’s a fact. In other words, it’s really an opinion.

This is surely understandable, but what is the excuse for letting his carelessly drawn distinction between voluntary and involuntary unemployment dominate aggregative thinking on labor markets for the forty years following?

Mr. Keynes, really, what is your excuse for being such an awful human being?

[I]nvoluntary unemployment is not a fact or a phenomenon which it is the task of theorists to explain. It is, on the contrary, a theoretical construct which Keynes introduced in the hope it would be helpful in discovering a correct explanation for a genuine phenomenon: large-scale fluctuations in measured, total unemployment. Is it the task of modern theoretical economics to ‘explain’ the theoretical constructs of our predecessor, whether or not they have proved fruitful? I hope not, for a surer route to sterility could scarcely be imagined.

Lucas, Id.

Let’s rewrite this paragraph with a few strategic word substitutions:

Heliocentrism is not a fact or phenomenon which it is the task of theorists to explain. It is, on the contrary, a theoretical construct which Copernicus introduced in the hope it would be helpful in discovering a correct explanation for a genuine phenomenon the observed movement of the planets in the heavens. Is it the task of modern theoretical physics to “explain” the theoretical constructs of our predecessors, whether or not they have proved fruitful? I hope not, for a surer route to sterility could scarcely be imagined.

Copernicus died in 1542 shortly before his work on heliocentrism was published. Galileo’s works on heliocentrism were not published until 1610 almost 70 years after Copernicus published his work. So, under Lucas’s forty-year time limit, Galileo had no business trying to explain Copernican heliocentrism which had still not yet proven fruitful. Moreover, even after Galileo had published his works, geocentric models were providing predictions of planetary motion as good as, if not better than, the heliocentric models, so decisive empirical evidence in favor of heliocentrism was still lacking. Not until Newton published his great work 70 years after Galileo, and 140 years after Copernicus, was heliocentrism finally accepted as fact.

In summary, it does not appear possible, even in principle, to classify individual unemployed people as either voluntarily or involuntarily unemployed depending on the characteristics of the decision problem they face. One cannot, even conceptually, arrive at a usable definition of full employment

Lucas, Id.

Belying his claim to be introducing scientific rigor into macroeocnomics, Lucas restorts to an extended scholastic inquiry into whether an unemployed worker can really ever be unemployed involuntarily. Based on his scholastic inquiry into the nature of volunatriness, Lucas declares that Keynes was mistaken because would not accept the discipline of optimization and equilibrium. But Lucas’s insistence on the discipline of optimization and equilibrium is misplaced unless he can provide an actual mechanism whereby the notional optimization of a single agent can be reconciled with notional optimization of other individuals.

It was his inability to provide any explanation of the mechanism whereby the notional optimization of individual agents can be reconciled with the notional optimizations of other individual agents that led Lucas to resort to rational expectations to circumvent the need for such a mechanism. He successfully persuaded the economics profession that evading the need to explain such a reconciliation mechanism, the profession would not be shirking their explanatory duty, but would merely be fulfilling their methodological obligation to uphold the neoclassical axioms of rationality and optimization neatly subsumed under the heading of microfoundations.

Rational expectations and microfoundations provided the pretext that could justify or at least excuse the absence of any explanation of how an equilibrium is reached and maintained by assuming that the rational expectations assumption is an adequate substitute for the Walrasian auctioneer, so that each and every agent, using the common knowledge (and only the common knowledge) available to all agents, would reliably anticipate the equilibrium price vector prevailing throughout their infinite lives, thereby guaranteeing continuous equilibrium and consistency of all optimal plans. That feat having been securely accomplished, it was but a small and convenient step to collapse the multitude of individual agents into a single representative agent, so that the virtue of submitting to the discipline of optimization could find its just and fitting reward.

I’m not sure why Keynes’s argument against wage cuts as a cure for unemployment was “flawed.” This argument is to be found in Chapter 19 of the GT and goes like this: Produces set the level of employment and output at the point of effective demand, which is the point at which employers expect to maximize their profits. In order to understand the way in which a cut in wages will affect employment and output it is necessary to explain how a cut in wages will affect effective demand, that is, the point at which produces expect to maximize their profits. Accordingly, in Chapter 19 Keynes examines various ways in which a change in wages can affect actual demand and, thereby, have an effect on effective demand and argued that cutting wages in an attempt to eliminate unemployment would lead to economic instability rather than solve the employment problem and concluded: “In the light of these considerations I am now of the opinion that the maintenance of a stable general level of money-wages is, on a balance of considerations, the most advisable policy for a closed system; whilst the same conclusion will hold good for an open system, provided that equilibrium with the rest of the world can be secured by means of fluctuating exchanges.” (1936, p. 270) Where is the flaw in Keynes’s argument and conclusion in this chapter? My understanding of this problem is explained in detail in https://rweconomics.com/MKATN.pdf

LikeLike

Neoclassical economics might, within the framework of a given set of assumptions and relative prices, account for the distribution of resources into various uses. It relies on one seemingly unspoken assumption, that the supply and demand functions are independent. At the microeconomic level, this is a reasonable assumption.

At the macroeconomic level, this assumption can no longer apply. It cannot apply because changes in expenditure (supply) affect changes in income (demand). One man’s expense becomes another’s income.

Theorists attempting to rehabilitate neoclassical economics as a theory of macroeconomics cannot rely on relative prices. I would appreciate anyone demonstrating how a change in relative prices can affect the level of employment as opposed to the distribution of employment among various uses.

There is only one way to explain changes in the level of employment (or any resource useage) and that is by invoking changes in the level of spending.

Lucas was absolutely embedded in kindergarten supply and demand thinking. And that is essentially why it fails as macroeconomic theory.

LikeLike

Relative prices do not change autonomously; they change for a reason, and the effect on employment depends on how that reason affects the rest of the economy. For example, an increase in thriftiness (a decrease in the demand for consumer goods) can be expected to change the prices of consumer goods relative to capital goods, but how it affects these relative prices depends on how the rest of the system reacts. An explanation as to how this works is examined in Figure 2 (An Increase in Thriftiness) and Section IV (Changes in the Money Wage in Keynes’ General Theory) in http://rweconomics.com/MKATN.pdf.

LikeLike

George, I think that Keynes did perceive the key problem with the argument for wage cuts in an economy with generally high unemployment. And I agree pretty much with the way that you characterize his position. The flaw I had in mind is his argument that falling wages would lead to correspondingly lower output prices so that the real wage would be unaffected. From a strict supply-demand perspective it’s not clear what the a priori reasoning is that product prices would fall as fast wages, leaving the real wage unaffected. One could also make a further argument that prices of labor intensive products would fall faster than prices of capital intensive products so that labor intensive product prices would fall faster than capital intensive products causing a net increase in the the demand for labor and employment. That’s pretty nitpicky, but those are the main points I had in mind.

Henry, I agree with the spirit of your comment, but I don’t accept that relative prices are irrelevant to the overall performance of an economy.

LikeLike

Mildly surprised to see no mentioned of Bewley (and why wages don’t fall during a recession).

LikeLike