Back in 2013 Karl Smith offered a startling rehabilitation of Arthur Burns’s calamitous tenure as Fed Chairman, first under Richard Nixon who appointed him, later under Gerald Ford who reappointed him, and finally, though briefly, under Jimmy Carter who did not reappoint him. Relying on an academic study of Burns by Fed economist Robert Hetzel drawing extensively from Burns’s papers at the Fed, Smith argued that Burns had a more coherent and sophisticated view of how the economy works and of the limitations of monetary policy than normally acknowledged by the standard, and almost uniformly negative, accounts of Burns’s tenure, which portray Burns either as a willing, or as a possibly reluctant, and even browbeaten, accomplice of Nixon in deploying Fed powers to rev up the economy and drive down unemployment to ensure Nixon’s re-election in 1972, in willful disregard of the consequences of an overdose of monetary stimulus.

According to Smith, Burns held a theory of inflation in which the rate of inflation corresponds to the average, or median, expected rate of inflation held by the public. (I actually don’t disagree with this at all, and it’s important, but I don’t think it’s enough to rationalize Burns’s conduct and policies as Fed chairman.) When, as was true in the 1970s, wages determined through collective bargaining between big corporations and big labor unions, the incentive of every union was to negotiate contracts providing members with wage increases not less than the average rate of wage increase being negotiated by other unions.

Given the pressure on all unions to negotiate higher-than-average wage increases, using monetary policy to reduce inflation would inevitably aggregate spending to fall short of the level needed to secure full employment, but without substantially moderating the rate of increase in wages and prices. As long as the unions were driven to negotiate increasing rates of wage increase for their members, increasing rates of wage inflation could be accommodated only by ever-increasing growth rates in the economy or by progressive declines in the profit share of business. But without accelerating real economic growth or a declining profit share, union demands for accelerating wage increases could be accommodated only by accelerating inflation and corresponding increases in total spending.

But rising inflation triggers political demands for countermeasures to curb inflation. Believing the Fed incapable of controlling inflation through monetary policy, restrictive monetary policy affecting output and employment rather than wages and prices, Burns concluded that inflation could controlled only by limiting the wage increases negotiated between employers and unions. Control over wages, Burns argued, would cause inflation expectations to moderate, thereby allowing monetary policy to reduce aggregate spending without reducing output and employment.

This, at any rate, was the lesson that Burns drew from the short and relatively mild recession of 1970 after he assumed the Fed chairmanship in which unemployment rose to 6 percent from less than 4 percent, with only a marginal reduction in inflation from the pre-recession rate of 4-5%, before Nixon, fearing his bid for re-election would fail, literally assaulted Burns, blaming him for a weak recovery that, Nixon believed, had resulted in substantial Republican losses in the 1970 midterm elections, just as a Fed-engineered recession in 1960 had led to his own loss to John Kennedy in the 1960 Presidential election. Here is how Burns described the limited power of monetary policy to reduce inflation.

The hard fact is that market forces no longer can be counted on to check the upward course of wages and prices even when the aggregate demand for goods and services declines in the course of a business recession. During the recession of 1970 and the weak recovery of early 1971, the pace of wage increases did not at all abate as unemployment rose….The rate of inflation was almost as high in the first half of 1971, when unemployment averaged 6 percent of the labor force, as it was in 1969, when the unemployment rate averaged 3 1/2 percent….Cost-push inflation, while a comparatively new phenomenon on the American scene, has been altering the economic environment in fundamental ways….If some form of effective control over wages and prices were not retained in 1973, major collective bargaining settlements and business efforts to increase profits could reinforce the pressures on costs and prices that normally come into play when the economy is advancing briskly, and thus generate a new wave of inflation. If monetary and fiscal policy became sufficiently restrictive to deal with the situation by choking off growth in aggregate demand, the cost in terms of rising unemployment, lost output, and shattered confidence would be enormous.

So in 1971 Burns began advocating for what was then called an incomes policy whose objective was to slow the rate of increase in wages being negotiated by employers and unions so that full employment could be maintained while inflation was reduced. Burns declared the textbook rules of economics obsolete, because big labor and big business had become impervious to the market forces that, in textbook theory, were supposed to discipline wage demands and price increases in the face of declining demand. The ability of business and labor to continue to raise prices and wages even in a recession made it impossible to control inflation by just reducing the rate of growth in total spending. As Burns wrote:

. . . the present inflation in the midst of substantial unemployment poses a problem that traditional monetary and fiscal policy remedies cannot solve as quickly as the national interest demands. That is what has led me…to urge additional governmental actions involving wages and prices….The problem of cost-push inflation, in which escalating wages lead to escalating prices in a never-ending circle, is the most difficult economic issue of our time.

As for excessive power on the part of some of our corporations and our trade unions, I think it is high time we talked about that in a candid way. We will have to step on some toes in the process. But I think the problem is too serious to be handled quietly and politely….we live in a time when there are abuses of economic power by private groups, and abuses by some of our corporations, and abuses by some of our trade unions.

Relying on statements like these, Karl Smith described Burns’s strategy as Fed Chairman as a sophisticated approach to the inflation and unemployment problems facing the US in the early 1970s when organized labor exercised substantial market power, making it impossible for monetary policy to control inflation without bearing an unacceptable cost of lost output and employment, with producers unable to sell the output that could be produced at prices sufficient to cover their costs (largely determined by union contracts already agreed to). But the rub is that even if unions recognized that their wage demands would result in unemployment, they would still find it in their self-interest not to moderate their wage demands.

[T]he story here is pretty sophisticated and well beyond the simplistic tale of wage-price spirals I heard as an econ student. The core idea is that while unions and corporations are nominally negotiating with each other, the real action is an implicit game between various unions.

One union, say the autoworkers, pushes for higher wages. The auto industry will consent and then the logic of profit maximization dictates that industry push at least some, if not all, of that cost on to their customers as high beer prices, and the rest on to their investors as a lower dividends and the government as lower taxes (since profits are lower.)

Higher prices for cars, increases the cost of living for most workers in the economy and thus lowers their real wages. In response, those workers will ask for a raise. Its straightforward how this will echo through the economy raising all prices. The really sexy part, however, is yet to come. The autoworkers union understands that all of this is going to happen, and so they push for even higher wages, to compensate them for the loss they know they are going to experience through the resulting ripple of price increases throughout the country.

Now, one might say – shouldn’t the self-defeating nature of this exercise be obvious and lead union leaders to give up? Oh [sic] contraire! The self-defeating nature of the enterprise demands that they participate. Suppose all unions except one stopped demanding excessive wage increases. Then the general increase in prices would stop and that one union would receive a huge windfall. Thus, there is a prisoners dilemma encouraging all unions to seek unreasonably high wage increases.

Yet, the plot thickens still. This upward push in prices factors into expectations throughout the entire economy, so that interest rates, asset prices, etc. are all set on the assumption that the upward push will continue. At that point the upward push must continue or else there will be major dislocations in financial markets. And, in order to accommodate that push the Fed must print more money. . . .

So, casting Burn’s view in our modern context would go something like this. Unemployment rises when inflation falls short of expected inflation. Expected inflation is determined by how much consumers think major corporations will raises their prices. Corporations plan price raises based on what they expect their unions to demand. Unions set their demands based on what they expect other unions to do. “Other unions” are always expected to make unreasonable demands because the unions are locked in prisoners dilemma. Actual inflation tends towards expected inflation unless the Fed curtails money growth.

Thus the Federal Reserve could only halt inflation by refusing to play along. . . In general, high unemployment would persist for however long it took to breakdown this entire chain of expectations. Moreover, unless the power of unions was broken the cycle would simply start back immediately after the disinflation.

No, instead the government had to find a way to get all participants in the economy to expect low inflation. How to do this? Outlaw inflation. Then unemployment need not rise since everyone expects the law to be followed. At that point the Federal Reserve could slow money creation without doing damage to the economy. Wage and price controls are thus a means of coordinating expectations.

Burns’s increasingly outspoken advocacy for an incomes policy after Nixon began pressing him to ease monetary policy in time to ensure Nixon’s re-election bore fruit in August 1971 when Nixon announced a 90-day wage and price freeze to be followed by continuing wage and price controls to keep inflation below 3% thereafter. Relieved of responsibility for controlling inflation, Burns was liberated to provide the monetary stimulus on which Nixon was insisting.

I pause here to note that Nixon had no doubt about the capacity of the Fed to deliver the monetary stimulus he was demanding, and there is no evidence that I am aware to suggest that Burns told Nixon that the Fed was not in a position to provide the desired stimulus.

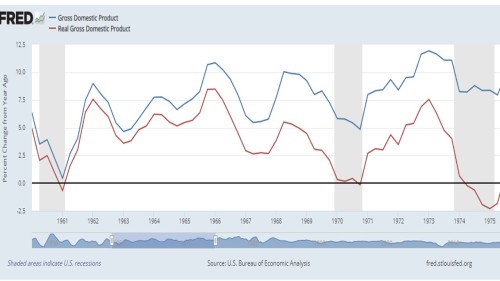

To place the upsurge in total spending presided over by Burns in context, the figure below shows the year over year increase in nominal GDP from the first quarter of 1960 in the last year of the Eisenhower administration when the economy was in recession through the second quarter of 1975 when the economy had just begun to recover from the 1974-75 recession that followed the Yom Kippur War between Israel and its Arab neighbors, which triggered an Arab embargo of oil shipments to the United States and a cutback in the total world output of oil resulting in a quadrupling of crude oil prices within a few months.

https://fred.stlouisfed.org/graph/?graph_id=552628

As Hetzel documents, Burns sought to minimize the magnitude of the monetary stimulus provided after August 15, 1971, instead attributing inflation to special factors like increasing commodity prices and devaluation of the dollar, as if rising commodity prices were an independent of cause of inflation, rather than a manifestation of it, and as if devaluation of the dollar was some sort of random non-monetary event. Rising commodity prices, such as the increase in oil prices after the Arab oil embargo, and even devaluation of the dollar could, indeed, be the result of external non-monetary forces. But the Arab oil embargo did not take place until late in 1973 when inflation, wage-and-price controls notwithstanding, had already surged well beyond acceptable limits, and commodity prices were rising rapidly, largely because of high demand, not because of supply disruptions. And it strains credulity to suppose that devaluation of the dollar was not primarily the result of the cumulative effects of monetary policy over a long period of time rather than a sudden shift in the terms of trade between the US and its trading partners.

Burns also blamed loose fiscal policy in the 1960s for the inflation that started rising in the late 1960s. But the notion that loose fiscal policy in the 1970s significantly affected inflation is inconsistent with the fact that the federal budget deficit exceeded 2% of GDP only once (1968) between 1960 and 1974.

It’s also clear that the fluctuation in the growth rate of nominal GDP in the figure above were quite closely related to changes in Fed policy. The rise in nominal GDP growth after the 1960 recession followed an easing of Fed policy while the dip in nominal GDP growth in 1966-67 was induced by a deliberate tightening by the Fed as a preemptive move against inflation that was abandoned because of a credit crunch that adversely affected mortgage lending and the home building industry.

When Nixon took office in Q1 1969 was 9.3% higher than in Q1 1968, the fourth consecutive quarter in which the rate of NGDP increase was between 9 and 10%. Having pledged to reduce inflation without wage and price controls or raising taxes, the only anti-inflation tool in Nixon’s quiver was monetary policy. It was therefore up to the Fed, then under the leadership of William McChesney Martin, an Eisenhower appointee, was thus expected to tighten monetary policy.

A moderate tightening, reflected in a modestly slower increases in NGDP in the remainder of 1969 (8% in Q2, 8.3% in Q3 and 7.2% in Q4) began almost immediately. The slowdown in the growth of spending did little to subdue inflation, leading instead to a slowing of real GDP growth, but without increasing unemployment. Not until 1970, after Burns replaced Martin at the Fed, and further tightened monetary policy, causing nominal spending growth to slow further (5.8% in Q1 and Q2, 5.4% in Q3 and 4.9% in Q4), did real GDP growth stall, with unemployment sharply rising from less than 4% to just over 6%. The economy having expanded and unemployment having fallen almost continuously since 1961, the sharp rise in unemployment provoked a strong outcry and political reaction, spurring big Democratic gains in the 1970 midterm elections.

After presiding over the first recession in almost a decade, Burns, under pressure from Nixon, reversed course, eased monetary policy to fuel a modest recovery in 1971, with nominal GDP growth increasing to rates higher than 1969 and almost as high as in 1968 (8% in Q1, 8.3% in Q2 and 8.4% in Q3). It was at the midpoint of Q3 (August 15) that Nixon imposed a 90-day wage-and-price freeze, and nominal GDP growth accelerated to 9.3% in Q4 (the highest rate since Q4 1968). With costs held in check by the wage-and-price freeze, the increase in nominal spending induced a surge in output and employment.

In 1972, nominal GDP growth, after a slight deceleration in Q1, accelerated to 9.5% in Q2, to 9.6% in Q3 and to 11.6% in Q4, a growth rate maintained during 1973. So Burns’s attempt to disclaim responsibility for the acceleration of inflation associated with accelerating growth in nominal spending and income between 1971 and 1973 was obviously disingenuous and utterly lacking in credibility.

Hetzel summed up Burns’s position after the imposition of wage-and-price controls as follows:

More than anyone else, Burns had created widespread public support for the wage and price controls imposed on August 15, 1971. For Burns, controls were the prerequisite for the expansionary monetary policy desired by the political system—both Congress and the Nixon Administration. Given the imposition of the controls that he had promoted, Burns was effectively committed to an expansionary monetary policy. Moreover, with controls, he did not believe that expansionary monetary policy in 1972 would be inflationary.

Perhaps Burns really did believe that an expansionary monetary policy would not be inflationary with wage-and-price controls in place. But if that’s what Burns believed, he was in a state of utter confusion. An expansionary monetary policy followed under cover of wage-and-price controls could contain inflation only as long as there was sufficient excess capacity and unemployment to channel increased aggregate spending to induce increased output and employment rather than create shortages of products and resources that would drive up costs and prices. To suppress the pressure of rising costs and prices wage-and-price controls would inevitably distort relative prices and create shortages, leading to ever-increasing and cascading waste and inefficiency, and eventually to declining output. That’s what began to happen in 1973 making it politically impossible, to Burns’s chagrin, to re-authorize continuation of those controls after the initial grant of authority expired in April 1974.

I discussed the horrible legacy of Nixon’s wage-and-price freeze and the subsequent controls in one of my first posts on this blog, so I needn’t repeat myself here about the damage done by controls; the point I do want to emphasize is, Karl Smith to the contrary notwithstanding, how incoherent Burns’s thinking was in assuming that a monetary policy leading aggregate spending to rise by a rate exceeding 11% for four consecutive quarters wasn’t seriously inflationary.

If monetary policy is such that nominal GDP is growing at an 11% rate, while real GDP grows at a 4% rate, the difference between those two numbers will necessarily manifest itself in 7% inflation. If wage-and-price controls suppress inflation, the suppressed inflation will be manifested in shortages and other economic dislocations, reducing the growth of real GDP and causing an unwanted accumulation of cash balances, which is what eventually happened under wage-and-price controls in late 1973 and 1974. Once an economy is operating at full capacity, as it surely was by the end of 1973, there could have been no basis for thinking that real GDP could increase at substantially more than a 4% rate, which is why real GDP growth diminished quarter by quarter in 1973 from 7.6% in Q1 to 6.3% in Q2 to 4.8% in Q3 and 4% in Q4.

Thus, in 1973, even without an oil shock in late 1973 used by Burns as an excuse with which to deflect the blame for rising inflation from himself to uncontrollable external forces, Burns’s monetary policy was inexorably on track to raise inflation to 7%. Bad as the situation was before the oil shock, Burns chose to make the situation worse by tightening monetary policy, just as oil prices were quadrupling, It was the worst possible time to tighten policy, because the negative supply shock associated with the rise in oil and other energy prices would likely have led the economy into a recession even if monetary policy had not been tightened.

I am planning to write another couple of posts on what happened in the 1970s, actually going back to the late sixties and forward to the early eighties. The next post will be about Ralph Hawtrey’s last book Incomes and Money in which he discussed the logic of incomes policies that Arthur Burns would have done well to have studied and could have provided him with a better approach to monetary policy than his incoherent embrace of an incomes policy divorced from any notion of the connection between monetary policy and aggregate spending and nominal income. So stay tuned, but it may take a couple of weeks before the next installment.

I thought it was Lyndon Johnson who “assaulted” William McChesney Martin

LikeLike

I forgot about that little episode. Funny how psychopathic Presidents sometimes just loose it.

LikeLike

Great stuff!

I really love reading about the history of this period in the US economy.

LikeLike

“It was the worst possible time to tighten policy, because the negative supply shock associated with the rise in oil and other energy prices would likely have led the economy into a recession even if monetary policy had not been tightened.”

What seems to be always forgotten is the massive transfer of income to oil producers. There was a demand side effect as well as a supply side effect.

And it was Keynesianism that was falsely blamed for the inflation of the 1970s when it was Burns and Nixon playing politics. Lucas and Sargent sought to wantonly bury Keynesianism in their diatribes..

LikeLike

William, Thanks so much.

Henry, Another reason why that was a bad time to start fighting inflation. I agree that Lucas and Sargent made many specious arguments in trying to discredit the then ruling Keynesian orthodoxy, but it really was monetary policy that was causing fluctuations in nominal and real GDP and inflation.

LikeLike

David,

To me the stagflation was easily explained.

The income shock caused the stagnation and the oil price shock caused the inflation.

Looking forward to see what you have to say about “Income and Money”.

LikeLike

I think you are being a little tough on poor Arthur Burns.

Remember that men operate in their time and place. We could say that President Washington was a completely horrible person, as he owned slaves. And certainly slavery is an inexcusable abomination.

I will comment more as the series unfolds, and I am looking forward to reading it.

LikeLike

Benjamin, I’m not charging Burns with moral turpritude, though I am not exonerating him of that either. I am accusing him of sloppy thinking. And I think I have already made a prima facie case to support that charge. In my next post, I will show in more detail exactly what was wrong with his ideas about incomes policies and how they could work in an anti-inflation strategy. Hawtrey worked it out beautifully in his book Incomes and Money, which I’m quite sure that Burns did not read and it is quite possible that he wasn’t even aware of it. Still, even without Hawtrey’s explanation, Burns should have realized that he was setting the stage for a burst of inflation no later than the beginning of 1973 after he secured his objective of helping Nixon get re-elected. But instead of tapering off the monetary stimulus he kept his foot on the accelerator for the rest of the year and then slammed on the brakes when the economy was absorbing a mighty supply shock, when continued monetary stimulus would have been in order to mitigate the recessionary impact of the supply shock. So Burns got it wrong coming and going.

LikeLike

Excellent post. NGDP is the elephant in the room, as you correctly point out. I’d add one footnote. Unions were extremely powerful during 1953-65, when inflation was low, and became weaker during the Great Inflation of 1966-81. So whatever caused the Great Inflation, it wasn’t increased unionization.

LikeLike

Thanks, Scott. It’s really remarkable how focusing on NGDP brings everything into much clearer focus in what was happening then. And as I will show in my next post, Hawtrey clearly understood that it is NGDP or NGI that tells you what the stance of monetary policy is. You may well be right that union power started to weaken in 1966, but I would have guessed — and it’s really no more than a guess — that union power began to wane in the 1970s. But I certainly agree that unionization was not the main cause of the inflation. I focused on that because Karl Smith, echoing Burns, believed unions were the key to the inflation/unemployment dilemma. I don’t dismiss that entirely, but I think it’s just one part of a larger picture.

LikeLike

What role did the Vietnam war play in the inflation? I moved to Seattle in 1974 and it was a ghost town due to the steep fall in Boeing orders. So it occurs to me that perhaps the rise (in 1966-1970) and fall (post 1972) in war materiel orders during a period of near full employment of both capital and labor may have something to do with the inflation.

LikeLike