In his Wednesday column (“Japan’s bumpy road to recovery“) in the Financial Times, the estimable Martin Wolf provided a sober assessment of the recent gyrations of the Japanese bond and stock markets and the yen. I was especially struck by this passage.

[C]riticism over the decline in the yen is coming from abroad. Many, particularly in east Asia, agree with the warning from David Li of Tsinghua University that, far from a rise in Japanese inflation, “the world has merely seen a sharp devaluation of the yen. This devaluation is both unfair on other countries and unsustainable.” In a letter to the FT, Takashi Ito from Tokyo responded: “I just find it unbearable that countries that have debased or manipulated their currency can accuse Japan of depreciating the yen”. This does begin to look like a currency war.

In a couple of posts last November about whether China was engaging in currency manipulation, I first gave China a qualified pass and then reversed my position after looking a bit more closely into the way in which the Chinese central bank (PBoC) was imposing high reserve requirements on commercial banks when creating deposits, thereby effectively sterilizing inflows of foreign exchange, or more accurately forcing the inflow of foreign exchange as a condition for expanding the domestic Chinese money supply to meet the burgeoning domestic Chinese demand to hold cash.

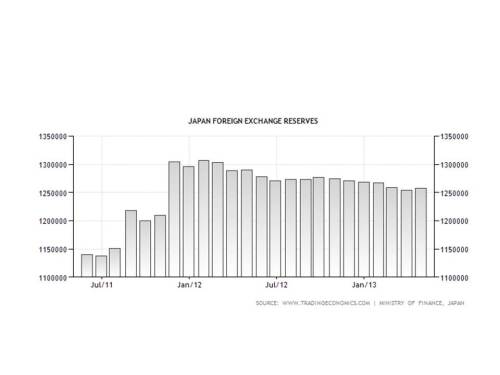

So to answer the question whether Japan has been manipulating its currency to drive down the value of the yen, the place to start is to look at what has happened to Japanese foreign-exchange holdings. If Japan has been manipulating its currency, then the reduction in the external value of the yen would be accompanied by an inflow of foreign exchange. The chart below suggests that Japanese holdings of foreign exchange have decreased somewhat over the past six months.

However, this item from Bloomberg suggests that the reduction in foreign exchange reserves may have been achieved simply by swapping foreign exchange reserves for different foreign assets which, for purposes of determining whether Japan is manipulating its currency, would be a wash.

Japan plans to use its foreign- exchange reserves to buy bonds issued by the European Stabilitylity Mechanism and euro-area sovereigns, as the nation seeks to weaken its currency, Finance Minister Taro Aso said.

“The financial stability of Europe will help the stability of foreign-exchange rates, including the yen,” Aso told reporters today at a briefing in Tokyo. “From this perspective, Japan plans to buy ESM bonds,” he said. The purchase amount is undecided, Aso said.

The move may help Prime Minister Shinzo Abe temper criticism of Japan’s currency policies from trading partners such as the U.S. The yen has fallen around 8 percent against the dollar since mid-November on Abe’s pledge to reverse more than a decade of deflation as his Liberal Democratic Party won an election victory last month.

“The Europeans would be happy to see Japan buy ESM bonds, so Japan can avoid criticism from abroad and at the same time achieve its objective,” said Masaaki Kanno, chief economist at JPMorgan Securities Japan Co. and a former central bank official.

So I regret to say that my initial quick look at the currency manipulation issue does not allow me to absolve Japan of the charge of being a currency manipulator.

It was, in fact, something of a puzzle that, despite the increase in Japanese real GDP of 3.5% in the first quarter, the implicit Japanese price deflator declined in the first quarter. If Japan is not using currency depreciation as a tool to create inflation, then its policy is in fact perverse and will lead to disaster. It would also explain why doubts are increasing that Japan will be able to reach its 2% inflation target.

I hope that I’m wrong, but, after the high hopes engendered by the advent of Abenomics, I am starting to get an uneasy feeling about what is happening there. I invite others more skillful in understanding the intricacies of foreign exchange reserves and central bank balance sheets to weigh in and enlighten us about the policy of the BoJ.

I don’t follow this. Why aren’t you looking at the Japanese CA balance?

LikeLike

I don’t understand why Market Monetarists get to lay sole claim to Abenomics, when others such as Krugman are hopeful. Japan is engaged in fiscal stimulus as well. I don’t consider myself an MM and yet remain hopeful that Japan will succeed.

I don’t understand what’s being said about currency manipulation. If Japan is buying European debt, it’s like they’re giving them cheap loans which they should use to boost their economy. It’s not Japan’s fault that they’re engaged in austerity.

LikeLike

Would you please remind us of the definition of ‘currency manipulation’, and, if it’s not obvious from your definition, explain why the activity is supposed to be *bad* (wrong, harmful to others)?

LikeLike

Japan is going only one way, and that is down. The money printing policy is just terrible. The BoJ has probably seen 20 new governors in the last 2 years alone.

LikeLike

Scott, Answer 1, CA depends on many things; FX reserves depends on what the CB wants, Answer 2, I’m lazy. Answer 3, also sleep deprived.

Peter K. I am not authorized to speak on behalf of MM. But there is a lot in common between what Abe said he would do and what MMs have been advocating. Come to think of it, there is a lot of common ground between what MMs and Krugman have been advocating.

Philo, by currency manipulation, I mean steps taken by the monetary authority to simultaneously reduce the nominal exchange rate, but without a corresponding increase in prices that would offset the reduced nominal exchange rate. The purpose of currency manipulation is to make the country’s tradable goods sector more profitable and thereby shift resources (labor and capital) into that sector. This sort of policy is similar to a uniform tariff on all imported products which would also tend to make the tradable goods sector of the tariff-imposing country more profitable. Part of increased profits in the tradable goods sector of the tariff-imposing country or the currency-manipulating country would come at the expense of factors of production employed in the tradable goods sectors of other countries.

Tas, Where did that number come from?

LikeLike

“there is a lot of common ground between what MMs and Krugman have been advocating.” … I’ve thought the same thing!

LikeLike

So the question is are they trying and failing to create inflation or are they not trying?

David, when you say that if they’re not trying this policy will lead to disaster I wonder if you could elaborate how this will be. A disaster because they get an unfair advantage for their tradable goods via other countries economies or for Japan as well.

Japan does make a good point that it’s ironic who is criticizing them for currency manipulation-China?!

LikeLike

First, on the matter of causation: since the monetary authority is always doing *something*, its activity is always a factor contributing to determining the currency’s exchange rate; whenever the currency’s exchange rate declines, this is partly due to the actions of the monetary authority. Then there is no real distinction between declines in the exchange rate that were, and those that were not, caused by the monetary authority. Even a decline that was reported in the press as caused by some non-monetary shock *could have been offset* by actions of the monetary authority, actions which it chose not to take. So you might as well have omitted the reference to “steps taken by the monetary authority” from your definition.

Then it seems to me that any unexpected decline in a currency’s exchange rate would have to count as “currency manipulation,” given the stickiness of (wages and) prices: prices will never adjust fast enough to an unexpected decline to avoid the effect of reducing real prices (in the short run).

I take it that your reference to “the purpose of currency manipulation” was not part of the definition, else we would have to know the mind of the monetary authority (presumably a collective entity, to which the ascription of purposes is philosophically suspect) before labeling it a currency manipulator.

Apparently currency manipulation is equivalent to a uniform tariff on all imported products, or a suitably apportioned direct governmental subsidy to manufacturers of goods for export (“tradable goods”). Is such a policy always bad? Our government, in effect, subsidizes poor residents of the U.S.; is that policy bad by the same reasoning?

LikeLike

Tom, So I’m not making it up.

Mike, It depends whether they are sterilizing the yen they are creating when they sell yen in the foreign exchange market by open market sales or by creating an additional domestic demand for yen, say, by increasing reserve requirements as the Chinese did. To find out will require further detective work.

If they are using the policy of depreciating the yen, not as a technique of inflation, but as a means of depreciating the real yen exchange rate, they are inviting retaliation by other countries that will be harmed by a reduction in demand for their tradable goods industries. I was thinking of the disaster from the perspective of the international economy. That’s all I meant. Whether it’s good for Japan or not, I don’t know, but I would not think it is in their enlightened self-interest.

Philo, The whole discussion started on the assumption that the decline in the yen over the past six months was the result of a policy decision by the Japanese. That is the assumption I am working under in replying to your question. If you don’t like the assumption, that is fine, but that is my assumption and I’m sticking to it.

There of course is a lag between a movement in the nominal exchange rate and the resulting adjustment in prices that offsets the change in the nominal exchange rate to return the real exchange rate to its original level. Two factors are involved in the adjustment. First price equilibration in the markets for tradable goods, and second an adjustment in domestic money supplies, as the money supplies in countries with depreciating currencies increase because they are selling their currencies in foreign exchange markets to force the value down, and correspondingly reducing the money supplies in countries whose currencies are being bought. The currency manipulation occurs when the country with the depreciating currency sterilizes the creation of new money as it sells its currency by raising lending rates or open-market sales, thereby obstructing the adjustment to the new exchange rate by creating a domestic excess demand for cash.

To avoid the psychological issue that you raise, currency manipulation can be defined as simultaneous sales of domestic currency in the foreign exchange markets coupled with rising interest rates or open market sales or other measures like increasing reserve requirements tending to sterilize the increase in the domestic money supply associated with sales of the domestic currency in the foreign exchange market. I don’t believe that I said that currency manipulation is equivalent to a uniform tariff, just that it was similar. There are undoubtedly ways in which the two policies differ.

LikeLike

“the implicit Japanese price deflator declined in the first quarter”

By definition, implicit price deflator declines if import deflator rises, other things being equal. Domestic price deflator remained unchanged in the first quarter. See p.19 of http://www.esri.cao.go.jp/jp/sna/data/data_list/sokuhou/files/2013/qe131/pdf/jikei_1.pdf

And according to http://www.mof.go.jp/english/international_policy/reference/feio/index.htm , Japanese MOF hasn’t intervened in foreign exchange market since January 2012.

LikeLike

“However, this item from Bloomberg suggests that the reduction in foreign exchange reserves may have been achieved simply by swapping foreign exchange reserves for different foreign assets which, for purposes of determining whether Japan is manipulating its currency, would be a wash.”

If I understand this correctly, it implies that though the chart indicates a decline in foreign exchange reserves, there is a possibility that reserves have been swapped for “different foreign assets”. Since the latter don’t appear on the chart, we simply can’t be sure that Japan is not accumulating forex. Adding forex reserves + “different foreign assets” could reveal a rise in total foreign assets.

I’ve found that the IMF defines Japan’s International Reserves and Foreign Currency Liquidity as including both foreign deposits and securities. So a swap of foreign deposits for securities would be captured in the data and your chart.

The page from whence you got your charts says: “reserves are made of gold or a specific currency. They can also be special drawing rights and marketable securities denominated in foreign currencies like treasury bills, government bonds, corporate bonds and equities and foreign currency loans.” — which implies that the series already captures “different foreign assets”.

But I could be misunderstanding you.

LikeLike