David Pearson, a regular and very acute commenter on this blog, responded with the following comment to my recent post about the remarkable 1933 recovery triggered by FDR’s devaluation of the dollar a month after taking office.

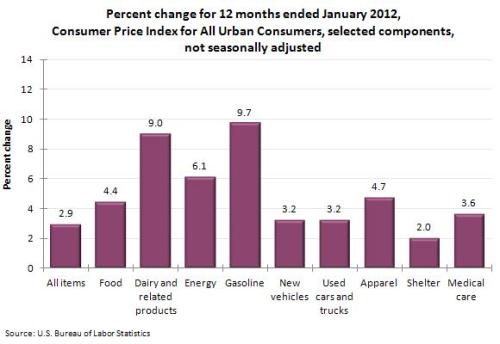

Here is a chart [reproduced below] showing the 12-mo. change in a broad range of CPI components. IMO, FDR would have been quite happy with this performance following 1933. The question is, if the Fed eased to produce 4-5% inflation, as MM’s recommend, what would each of these components look like, and how would that affect l.t. household real wage growth expectations? In turn, what impact would that have on current real household spending?

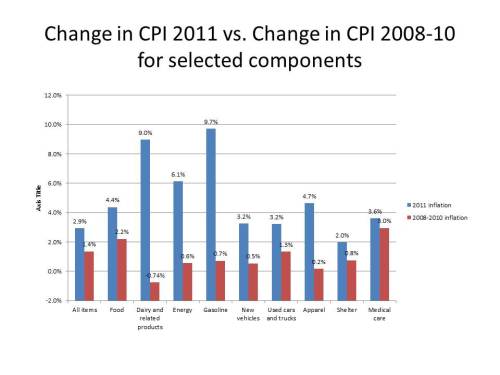

I inferred from David’s comment and the chart to which he provided a link that he believes that recent inflation has been distorting relative prices, and that he worries that increasing inflation would amplify the relative-price distortions. I thought that it would be useful to track the selected components in this chart more than one year back, so I created another chart showing the average rate of change in the CPI and in the selected components from January 2008 to January 2010 along side the changes from January 2011 to January 2012. There seems to be some inverse correlation between the rate of price increase in a component in the 2008-10 period and the price increase in 2011. Of the 6 components that increased by less than 1% per year in the 2008-10 period, four increased in 2011 by 4.7% or more in 2011, the remaining components increasing by 4.4% or less in 2011. So the rapid increases in some components in 2011 may simply reflect a reversion to a more normal pattern of relative prices.

I agree that inflation is not neutral. There are relative price effects; some prices adjust faster than others, but I don’t think we know enough about the process of price adjustment in the real world to be able to say that overall inflation in conditions of high unemployment amplifies relative distortions. What we do know is that even after a pickup in inflation in 2011, inflation expectations remain low (though somewhat higher than last summer) and real interest rates are negative or nearly negative at up to a 10-year time horizon. Negative real interest rates are an expectational phenomenon, reflecting the extremely pessimistic outlook of investors. Increasing future price-level expectations is one way – I think the best way — to improve the investment outlook for businesses. We are in an expectational trap, not a liquidity trap, and an increase in price-level expectations would generate a cycle of increased investment and output and income and entrepreneurial optimism that will be self-sustaining. Say’s Law in action; supply creates its own demand.

In a more recent comment on the same post, David Pearson worries that insofar as inflation would tend to reduce real wages, it will cause wage earners and households to cut back on consumption, thereby counteracting any stimulus to investment by business from expectations of rising prices. To the extent that expectations of future wage growth fall, workers may also revise downward their reservation wages, so, even if David is right, the effect on employment is not clear. But I doubt that short-term changes in the inflation rate cause significant changes in expectations of future wage and income growth which are dependent on a variety of micro factors peculiar to individual workers and their own particular circumstances. As usual David makes a good argument for his point of view, but I am not persuaded. But then I don’t suppose that I have persuaded him either.

David,

Thanks for presenting the argument in such a clear manner. I think you did it justice, and that your counter-arguments are valid, even if I might disagree.

I thought this set of charts (from a recent paper on housing) might enlighten the debate.

http://www.businessinsider.com/the-two-things-that-have-really-held-back-this-recovery-2012-2

They show that, in fact, business investment and exports — two components that wold be influenced by a 1933-type devaluation — have recovered at the same pace or better than the average of previous recessions. The issue is not business optimism (or profits), nor are negative interest rates caused by pessimism. The conclusion of the authors is that monetary policy has already worked to increase investment, but that much stronger doses are required to move housing investment. At those doses, the authors believe that relative prices might become distorted.

In the end, its a question of whether trade-offs exist for monetary policy, or whether there is a “free lunch” as there was in 1933. Again, thanks for presenting one dissenting view.

LikeLike

I’m not sure that there is any discernable difference in terms of policy prescriptions between what you term an “expectations trap” and a “liquidity trap”. From my understanding, they are basically the same thing. The full-employment equilibrium real rate of interest is negative, so the main issue is not pushing the nominal rate lower (because there isn’t any traction to speak of), but raising inflation expectations. But raising aggregate demand through stimulus will raise the equilibrium real interest rate, perhaps to the point where a zero-percent nominal interest rate is enough to reach the equilibrium. Any criticism is welcomed.

LikeLike

In my opinion, there is always a trade off in Economics -except in very special cases: a profound deflation. MP is not different.

LikeLike

Let’s see, yessir, that price signal tells me a lot.

When I visit a doctor, car mechanic, buy a house, health insurance, lawyer, college education, or used car, I rely on the price signal–not.

I lean on (dimly) perceived quality and a guess about final price. Usually I am guessing with poor knowledge and weak intuition.

About the only time I am not guessing is when I buy commodities with gyrating prices, such as gasoline, apples or chicken. Then I know what competitors are charging. I am fierce with my grocery flyers and can read gas price signs as well as the next guy.

But what is my house worth? Why? Location? And the foundation has been inspected–but cracks two years later. Don’t even ask about the roof.

The stretch to suggest that inflation distorts price signals in a meaningful way in the modern economy to just another effort by Theo-Monetarists to find some rational for currency worship or genuflection to gold.

Really, let’s obsess instead on real growth and boom times. I have a peevish fixation that monetary policy should spur growth. Call me crazy.

LikeLike

I was thinking, are price distortions necessarily so bad? What might be seen as a distortion might be seen, from a different angle, as the adjustment of relative prices to those that are consistent with a return to full employment. Is there something wrong with this way of thinking about prices?

LikeLike

David, You’re welcome. I am glad that you feel that I did justice to your side. I do appreciate your comments, which are always clear and thoughtful and force me to think more carefully about the logic of my own position. Thanks for the link. Here’s my initial take. If business investment and exports have been performing about as well in this recovery compared as in others, that still may not be good enough, because this downturn was so deep. So we would want the strongest performers in this recovery to do better than average even if the other sectors were performing adequately. So I am not willing to give exports and business investment a passing grade just because they are doing about as well as average.

Julian, You are right that there is not necessarily any analytical or policy distinction between a liquidity trap and an expectational trap. My distinction between them was partly rhetorical and partly just to focus on the underlying cause of the trap.

Luis, At the risk of getting Greg Ransom even more upset with me than he is already, I will just point out once again that Hayek recognized that in a deep depression, with all or nearly all resources in excess supply, the usual trade-offs that are the bread and butter of “regular economics” don’t apply. I am not sure that such a situation actually exists, but we are not that far away from it.

Benjamin, Your point is well taken. On the other hand, prices do send important signals even if not every transactor is responding to them. Prices serve an important signaling function even when only the supplier and the demander at or near the margin is paying any attention.

Julian, Once again it’s complicated. Prices serve their function optimally only when prices are at or near their equilibrium values. When the price system is way out of whack (which is arguably the case now), a given price change is not necessarily taking us closer to equilibrium; it may be moving us farther away. There really is no guarantee that price adjustment in the real world takes us in the direction of the equilibrium. This is the (largely unnoticed) message of Hayek’s incredibly important paper “Economics and Knowledge.” Axel Leijonhufvud has suggested a variation on that theme, positing the existence of what he called a “corridor,” the idea being that economies function more or less normally when they are in some sense not too far a away from equilibrium. In those circumstances, deviations from equilibrium are self-correcting. However, if a shock is too great, causing the economy to go outside the corridor, the normal self-steering mechanism of a well-functioning economy no longer is operative. That is when strong macroeconomic policy becomes necessary to guide the economy back into the corridor so that normal equilibrating processes can again keep the economy more or less on track.

LikeLike