UPDATE (October 30 (9:22pm EDST): Commenter BJH correctly finds a basic flaw in my little attempt to infer some causation between Trump’s effect on the peso, the peso’s correlation with the S&P 500 and Trump’s effect on the stock market. The correlation cannot bear the weight I put on it. See my reply to BJH below.

The little swoon in the stock markets on Friday afternoon after FBI Director James Comey announced that the FBI was again investigating Hillary Clinton’s emails coincided with a sharp drop in the Mexican peso, whose value is widely assumed to be a market barometer of the likelihood of Trump’s victory. A lot of people have wondered why the stock market has not evidenced much concern about the prospect of a Trump presidency, notwithstanding his surprising success at, and in, the polls. After all, the market recovered from a rough start at the beginning of 2016 even as Trump was racking up victory after victory over his competitors for the Republican presidential nomination. And even after Trump’s capture of the Republican nomination was seen as inevitable, even though many people did start to panick, the stock markets have been behaving as if they were under heavy sedation.

So I thought that I would do a little checking on how the market has been behaving since April, when it had become clear that, barring a miracle, Trump was going to be the Republican nominee for President. Here is a chart showing the movements in the S&P 500 and in the dollar value of the Mexican peso since April 1 (normalized at their April 1 values). The stability in the two indexes is evident. The difference between the high and low values of the S&P 500 has been less than 7 percent; the peso has fluctuated more than the S&P 500, presumably because of Mexico’s extreme vulnerability to Trumpian policies, but the difference between the high and low values of the peso has been only about 12%.

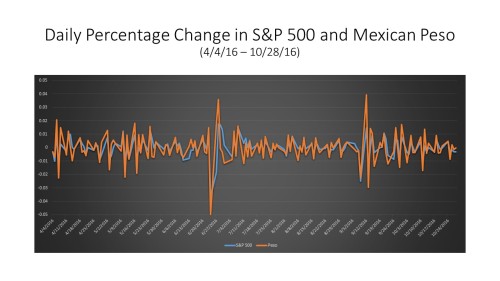

But what happens when you look at the daily changes in the S&P 500 and in the peso? Looking at the changes, rather than the levels, can help identify what is actually moving the markets. Taking the logarithms of the S&P 500 and of the peso (measured in cents) and calculating the daily changes in the logarithms gives the daily percentage change in the two series. The next chart plots the daily percentage changes in the S&P 500 and the peso since April 4. The chart looks pretty remarkable to me; the correlation between changes in the peso and change in the S&P 500 is striking.

A quick regression analysis on excel produces the following result:

∆S&P = 0.0002 + .5∆peso, r-squared = .557,

where ∆S&P is the daily percentage change in the S&P 500 and ∆peso is the daily percentage change in the dollar value of the peso. The t-value on the peso coefficient is 13.5, which, in a regression with only 147 observations, is an unusually high level of statistical significance.

This result says that almost 56% of the observed daily variation in the S&P 500 between April 4 and October 28 of 2016 is accounted for by the observed daily variation in the peso. To be precise, the result doesn’t mean that there is any causal relationship between changes in the value of the peso and changes in the S&P 500. Correlation does not establish causation. It could be the case that the regression is simply reflecting the existence of causal factors that are common to both the Mexican peso and to the S&P 500 and affect both of them at the same time. Now it seems pretty obvious who or what has been the main causal factor affecting the value of the peso, so I leave it as an exercise for readers to identify what factor has been affecting the S&P 500 these past few months, and in which direction.

All assets are going to have a high beta to the equity market. You need to compare the beta of peso returns to the beta of other currencies, not to zero

LikeLike

BJH, Good point, which I overlooked in my enthusiasm for the high and positive correlation that I found in a small sample. My intuition tells me that the recent correlation between movements in the peso and in the S&P 500 is more than coincidental, but the complex underlying interrelationships can’t be inferred from a simple regression on a small smaple. Oh well.

LikeLike

As you already observed, it is not easy to filter out spurious correlations when using the value of the Mexican as a market barometer of the likelihood of Trump’s victory.

As a more general point about the stock market, only an event that very directly effects it tends to have a lasting impact. One of the most poignant but meaningful examples is the assassination of JFK. The NYSE and AMEX dropped sharply the next trading day, but recovered in less than a week. I am now curious what sort of event a president-elect Trump could cause, or even once he were in office, that would take a big, quick, and long-lasting bite out of US equity markets. I hope that it doesn’t come to that. #MAGA

LikeLike

Er, crud, sorry, I made typos. I meant to say, “Mexican peso”.

LikeLike

One could argue that, when the current slate of multinational corporations, whose stranglehold over the political process is fairly unassailable, have been extracting rents via tax evasion as well as the ‘old fashioned’ way, it’s a “good” thing to see a shake-up.

That said, trump’s tax plans do nothing to help swing the pendulum of power away from corporations. So the impact on the peso sort of makes sense. And despite her big talk to the contrary, anyone with an objective view of the clintons would be loathe to expect any disruption of corporate governance and operation (all their $200M net worth is from the largess of these same actors – knocking them upside their financial heads is an extremely unlikely event). Besides, the clintons love their power and will want to remain the gatekeepers of the DNC (or pass it along to their henchmen). Without billionaire cash to gate, control over the party apparatus is much harder to retain.

So for argument’s sake, let’s say that view of the clintons is correct (and the wikileaks email releases – none of which have been proved illegitimate – help confirm that view). If she is elected, would a “positive” reaction from the stock market (which we all know disproportionately helps the extremely wealthy) prove that her coronation is “good” for the US or the world?

And if not, then isn’t it fair to say that no one should care what the impact of an election is on the stock market? If the economy exists as a means to advance and stabilize a society, and that economy is failing to perform that function, then why should society care about what the richest think about the value of companies and currencies at any time?

This is one of the things that has driven me insane with obama – he’s so intimidated by the titans of industry and wall street (and has admitted as much to reporters and at the podium – “I have to be very careful what I say… can move markets…”) that he is/was, almost literally, held hostage by their aura. If the stock market cares about elections, then we should accept the fact that it’s going to go down when someone rises to power and clips the wings of the rentiers. Those who say, “but my 401K!” tacitly admit that they, too, are hostages.

LikeLike

It makes sense that the market would favor Hillary over Trump. Hillary is very much the candidate of Wall Street, Goldman Sachs, the corporate elite, the plutocracy, etc. For better or worse, Donald Trump is not. The dominant cosmopolitan elite of our time unabashedly supports policies (“free trade”, Open Borders, financialization of the economy, etc) that maximize inequality, corporate bonuses, etc. irrespective of the damage to the American people and the U.S. economy. Of course, Hillary pays lip service to inequality (it’s the trendy cosmopolitan thing to do). What she really thinks about inequality was revealed by WikLeaks. She threw a major-league temper tantrum when her aids suggested that it might not be wise for Bill to take a six-figure payment from Morgan Stanley (https://heatst.com/politics/wikileaks-hillary-clinton-wall-street/).

Of course, Hillary hasn’t been shy about expressing her loyalty to Goldman Sachs. Her Goldman speeches have leaked and in private she is a near perfect sycophant. Goldman has returned the favor by banning contributions to Trump and allowing contributions to Hillary. Of course, the same pattern holds internationally as well. Check out the Brexit vote, the Ukraine referendum in the Netherlands, the election in Austria, etc. Everywhere (in the West and parts of the East) that cosmopolitan elite have rebelled against the people and the people are rebelling against them.

LikeLike

A number of other folks have made this point… However, high asset correlations are not new. 15 years ago, Latin American stock markets moved in lockstep with the NASDAQ. Why wasn’t self-evident then (or even in retrospect). However, the concept of beta correlation was probably the correct explanation for the high correlation 15 years ago. It is probably also the correct explanation for the current linkage between the Peso and the U.S. market.

An easy test (in the future) will be to check the Peso / stock market correlation after the election (irrespective of who wins). My guess is that the correlation will remain relatively constant.

LikeLike

Well, interesting post, and who knows?

I especially like the antique spelling of “panick.”

“even though many people did start to panick”

Reminds of my days as an antiquarian map and book collector.

Anyway, I cannot believe Trump can win,

The GOP will remain a confederacy of warmongering catamites for plutocrats, and the Donks sniveling socialists.

Forward!

LikeLike

Ellie, You said:

“I am now curious what sort of event a president-elect Trump could cause, or even once he were in office, that would take a big, quick, and long-lasting bite out of US equity markets.”

You don’t think that the President of the US can affect the US economy or that the stock market is affected by the US economy? That’s pretty interesting.

“I hope that it doesn’t come to that.”

Come to what?

“#MAGA”

Oh please.

Tim,

“One could argue that, when the current slate of multinational corporations, whose stranglehold over the political process is fairly unassailable, have been extracting rents via tax evasion as well as the ‘old fashioned’ way, it’s a “good” thing to see a shake-up.”

That’s not arguing; that’s emoting.

I am far from attributing perfect efficiency to the stock market, and there are all kinds of reasons to question whether the interests of society are perfectly aligned with the interests of shareholders, but it is simply ridiculous to think that the stock market is rigged or manipulated by a particular group of people who can control the direction in which stock prices move.

Peter, You said:

“Of course, Hillary hasn’t been shy about expressing her loyalty to Goldman Sachs.”

Actually she has been exceptionally shy about expressing loyalty to Goldman Sachs, which is why she has refused to release the transcripts of her speeches. So your grasp on reality seems a bit shaky to me.

“Her Goldman speeches have leaked and in private she is a near perfect sycophant.”

When was the last time you heard a politician make a speech in which he or she was not sucking up to his or her intended audience? For someone as well-read as yourself, you seem remarkably naïve.

Benjamin, You said:

“I especially like the antique spelling of ‘panick.’”

I can’t explain how that happened. I don’t know what came over me. Must have been having a panic attack.

“Anyway, I cannot believe Trump can win,”

Nor I. But I’m still shivering in my boots.

LikeLike

@David

“I am far from attributing perfect efficiency to the stock market, and there are all kinds of reasons to question whether the interests of society are perfectly aligned with the interests of shareholders, but it is simply ridiculous to think that the stock market is rigged or manipulated by a particular group of people who can control the direction in which stock prices move.”

Uh, can you please do me a favor and highlight the sentences where I’d written anything remotely similar to the interpretation I’ve quoted from you above?

LikeLike

Thomas Frank, of “What’s the Matter with Kansas?” fame (and impeccable liberal/left convictions) wrote a decent article about the election. See “Forget the FBI cache; the Podesta emails show how America is run” (https://www.theguardian.com/commentisfree/2016/oct/31/the-podesta-emails-show-who-runs-america-and-how-they-do-it). A few quotes should help.

“The emails currently roiling the US presidential campaign are part of some unknown digital collection amassed by the troublesome Anthony Weiner, but if your purpose is to understand the clique of people who dominate Washington today, the emails that really matter are the ones being slowly released by WikiLeaks from the hacked account of Hillary Clinton’s campaign chair John Podesta. They are last week’s scandal in a year running over with scandals, but in truth their significance goes far beyond mere scandal: they are a window into the soul of the Democratic party and into the dreams and thoughts of the class to whom the party answers.”

“They are the comfortable and well-educated mainstay of our modern Democratic party. They are also the grandees of our national media; the architects of our software; the designers of our streets; the high officials of our banking system; the authors of just about every plan to fix social security or fine-tune the Middle East with precision droning. They are, they think, not a class at all but rather the enlightened ones, the people who must be answered to but who need never explain themselves.”

“Certain industries loom large and virtuous here. Hillary’s ingratiating speeches to Wall Street are well known of course, but what is remarkable is that, in the party of Jackson and Bryan and Roosevelt, smiling financiers now seem to stand on every corner, constantly proffering advice about this and that. In one now-famous email chain, for example, the reader can watch current US trade representative Michael Froman, writing from a Citibank email address in 2008, appear to name President Obama’s cabinet even before the great hope-and-change election was decided (incidentally, an important clue to understanding why that greatest of zombie banks was never put out of its misery).”

“Certain industries loom large and virtuous here. Hillary’s ingratiating speeches to Wall Street are well known of course, but what is remarkable is that, in the party of Jackson and Bryan and Roosevelt, smiling financiers now seem to stand on every corner, constantly proffering advice about this and that. In one now-famous email chain, for example, the reader can watch current US trade representative Michael Froman, writing from a Citibank email address in 2008, appear to name President Obama’s cabinet even before the great hope-and-change election was decided (incidentally, an important clue to understanding why that greatest of zombie banks was never put out of its misery).”

and from “The Republicans and Democrats failed blue-collar America. The left behind are now having their say” (https://www.theguardian.com/commentisfree/2016/nov/06/republicans-and-democrats-fail-blue-collar-america)

“Let us start with the Democrats. Were you to draw a Venn diagram of the three groups whose interaction defines the modern-day Democratic party – liberals, meritocrats and plutocrats – the space where they intersect would be an island seven miles off the coast of Massachusetts called Martha’s Vineyard.”

“But what has also made Trumpism possible is the simultaneous evolution of the Democrats, the traditional workers’ party, over the period I have been describing. They went from being the party of Decatur to the party of Martha’s Vineyard and they did so at roughly the same time that the Republicans were sharpening their deadly image of the “liberal elite”.”

“And so the reversal is complete and the worst choice ever is upon us. We are invited to select between a populist demagogue and a liberal royalist, a woman whose every step on the campaign trail has been planned and debated and smoothed and arranged by powerful manipulators. The Wall Street money is with the Democrats this time, and so is Silicon Valley, and so is the media, and so is Washington, and so, it sometimes seems, is righteousness itself. Hillary Clinton appears before us all in white, the beneficiary of a saintly kind of subterfuge.”

Like it or not, the Democrats are now the party of the upscale elite. Predictably, Wall Street cheers for Hillary and responds favorably to any good new for her. Unfortunately, good news for Hillary and Wall Street is almost certainly bad news for America.

LikeLike

Sorry for being so tardy in responding to these comments. But for what it’s worth here are my responses:

Tim, You quoted me @David

“I am far from attributing perfect efficiency to the stock market, and there are all kinds of reasons to question whether the interests of society are perfectly aligned with the interests of shareholders, but it is simply ridiculous to think that the stock market is rigged or manipulated by a particular group of people who can control the direction in which stock prices move.”:

And then you asked:

“Uh, can you please do me a favor and highlight the sentences where I’d written anything remotely similar to the interpretation I’ve quoted from you above?”

Well, I may not have been reading you correctly, but I think my response was largely to these two paragraphs at the end of your comment, which, of course have to be read in the light of what preceded those paragraphs.

“[I]sn’t it fair to say that no one should care what the impact of an election is on the stock market? If the economy exists as a means to advance and stabilize a society, and that economy is failing to perform that function, then why should society care about what the richest think about the value of companies and currencies at any time?

“This is one of the things that has driven me insane with obama – he’s so intimidated by the titans of industry and wall street (and has admitted as much to reporters and at the podium – “I have to be very careful what I say… can move markets…”) that he is/was, almost literally, held hostage by their aura. If the stock market cares about elections, then we should accept the fact that it’s going to go down when someone rises to power and clips the wings of the rentiers. Those who say, “but my 401K!” tacitly admit that they, too, are hostages.”

I probably misspoke in attributing to you the idea that the stock market is manipulated by a particular group of people. You are making a somewhat different point, but it still seems to me to be borderline ridiculous. I mean the S&P 500 was at about 650 at the bottom of the Little Depression when unemployment was at 10%. Do you think the increase of the S&P 500 to its current level of 2100 or so is unrelated to the relative well being of the economy and society since 2009. Or do you think we were all better off in 2009 when the S&P 500 was at 650 than we are today?

Peter, First of all, at the risk of reopening an old argument, I will say flatly that Thomas Frank is not a liberal by any stretch of the imagination. He is a leftist, not a liberal and liberalism is not now and never has been synonymous with leftism. I am not a fan of the financial sector, which I think engages in a colossal waste of resources as I have observed a few times previously on this blog. There is also a tremendous waste of resources associated with the ra ce to create and protect intellectual property. Just because there are imperfections – serious imperfections – with the way our economy is now functioning does not mean that the know-nothingism — the arrogant and belligerent know-nothingism — of the candidate by whom you so enthralled will make things any better. Things could get a low worse.

LikeLike

“I probably misspoke in attributing to you the idea that the stock market is manipulated by a particular group of people. You are making a somewhat different point, but it still seems to me to be borderline ridiculous.”

David, you seem to imply that the stock market is free and open, uncorrupted, incorruptible, and the expression of the true condition of an economy. This is a patent falsehood and laughable. It is simply the valuation of businesses according to the 1% and their financial advisors and fund managers (as they control, last I saw a number on it, over 85% of all stocks and bonds). Casting any more to its meaning is, to use your favored term, ridiculous.

When looking at the averages over the last 15 years, the stock markets have done rather well while the middle class and poor have been watching their ability to afford life’s essentials steadily erode. While I have seen plenty of studies that correlate the financial health of the 1% to the performance of stock markets (reasonable since their capital income is a monstrous share of their “earnings”), you seem to want to correlate to the economic strength of the 99% AND the 1% – but that utterly fails. There is no symmetry at all.

You sound like you’re blowing the dust off the old, “What’s good for General Motors is good for America,” shtick. That has long been quashed.

LikeLike

Tim, You said:

”David, you seem to imply that the stock market is free and open, uncorrupted, incorruptible, and the expression of the true condition of an economy.”

The stock market is free in the sense that people can buy and sell stocks at prices that they are willing to pay or accept. It is open in the sense that no one who wants to buy or sell stocks is excluded from participating the market. It is a truism that in order to sell you need to own a stock or be prepared to buy a stock that you are contracting to sell. And it a truism that in order to buy a stock, you need to have the money to pay for it or be able to borrow the money you need to buy it.

What part of my description do you regard as either false or laughable?

You said:

“It is simply the valuation of businesses according to the 1% and their financial advisors and fund managers (as they control, last I saw a number on it, over 85% of all stocks and bonds).”

I don’t know what you mean by “the valuation of business according to the 1%.” How does the 1% value anything. They are buying and selling, buyers place a higher value on the stock than the sellers do. That statement comes close to the statement that I attributed to you previously which you denied having made.

You said:

“Casting any more to its meaning is, to use your favored term, ridiculous.”

I am afraid that you will have to parse that one for me before I can respond. I can’t figure out what it means.

You said:

“When looking at the averages over the last 15 years, the stock markets have done rather well while the middle class and poor have been watching their ability to afford life’s essentials steadily erode.”

We can look at the averages over the last 15 years. What data are you referencing to support your statement about the ability of the middle class and the poor to afford life’s essentials?

You said:

“While I have seen plenty of studies that correlate the financial health of the 1% to the performance of stock markets (reasonable since their capital income is a monstrous share of their “earnings”), you seem to want to correlate to the economic strength of the 99% AND the 1% – but that utterly fails. There is no symmetry at all.”

I made a simple statement that most people in this country are better off now than they were in 2009? Don’t tell me what I am trying to do with the 99% and the 1%. Just say whether you agree or disagree that most people in the country are better off than they were in 2009?

You said:

“You sound like you’re blowing the dust off the old, “What’s good for General Motors is good for America,” shtick. That has long been quashed.”

Oh please. Now who is putting words into whose mouth? Talk about ridiculous.

LikeLike

You debate like a Correct the Record troll.

My original statement was that no one should care what the stock market does before, during, or after an election. It’s going to do what it’s going to do as those 1% folks trade stocks during their perpetual process of evaluating future winners and future losers.

What the peso does in response to an election has no reflection of what’s actually going to happen, who is helped, who is hurt, and who is left alone. It’s just like making a bet in September on who’s going to win the Super Bowl – it has absolutely zero bearing on who actually ends up winning the Super Bowl. The winner may be the team that was favored, but it usually isn’t. So why care at all about what the gamblers think during the pre-season?!? It’s pointless!

That’s it. Maybe I’ve said too much and allowed myself to follow your meandering logic to places that are irrelevant. But my basic premise stands. The stock market will do whatever it’s going to do and there is no value whatsoever in discussing movements that coincide with politician activities – unless you own a few billion pesos, I suppose… in which case, you’d dial up your DC lobbyists and unleash them on their marks so that conditions can be changed back in favor of your peso holdings.

LikeLike

Tim, I actually have no idea what it means to debate like a “correct the record troll.” But i suspect you were not intending to flatter me.

In order to establish that the behavior of the stock market are irrelevant to people who don’t trade in the stock market, you would have to show that stock prices are uncorrelated or inversely correlated with the current performance of the economy. You would also have to show that stock prices do not anticipate future movements of the economy. I think that both of those statements are false, though I would certainly acknowledge that the correlations are far from perfect,

You are right that making bets on future outcomes don’t affect the outcomes, but people who make bets on future outcomes have an incentive to use any formation that bears on the likelihood of those outcomes. Favorites usually win the contests that they are favored to win and underdog usually lose because, bettors, using the available information, can pick winners more often than they could by trying to choose randomly. As much as you may dislike that way of looking the process by which stock prices are determined you have not offered any substantive argument to refute it.

LikeLike

David, I don’t believe there is much more needed than some simple observation to see many of the reasons for higher stock prices which don’t correlate to economic performance. Perhaps you’re blinded to these things because you, as an economist, have more of a focus on formulas and theoretical constructs.

I’ll offer a few things that are not direct “dollars and cents” issues, but they directly translate into economic performance FROM THE PERSPECTIVE OF THE POPULATION. These are things that most economists, from my observation, prefer to ignore because they are “subjective.” It’s also annoying to some because the human element forces a sometimes uncomfortable reckoning with conscience. However, these “subjective” matters are things that lead to a President Trump, armed insurrection (Arab Spring), etc.

1.) The vast majority of Dow Jones stocks are international in nature. A trite example: If the stock of a US kobe beef growing conglomerate, whose customers are in Japan, is strong, how does that reflect the slightest on the US economy? It doesn’t. And in instances where a company’s market is global, their stock price reflects their targeted customers (who are usually not the impoverished) – not a “good economy.” Apple sells to places that have people with the discretionary income to afford luxury-priced communications equipment and a good cellular infrastructure. The ‘at large’ economic performance of their customer’s nation is also generally irrelevant to Apple’s stock.

2). Many companies whose stocks are traded depend on international suppliers. While foreign supplies are reliably shipped and cheap (for whatever myriad of reasons, but often associated with worker subjugation and cheap, short-term environmental destruction), things go well. However, since this exploitation of people and resources has a cost to someone else, the stock prices are indifferent to the impending suffering to the economic participants/victims of these dependencies. Conversely, if the exploitation ceases and stocks of the effected, upstream company(ies) plummets, we have a choice to either cheer/boo the potential improvement of the changing conditions of the exploited or those of the potentially displaced workers (or lost consumers, whatever) on the other side. So which is it? To me, the plight of the stock market is irrelevant.

3). Many industries enjoy increasing market dominance through monopsony and mon-, du-, and other ‘opolies.’ As recent published studies have shown (I’m sure you’ve seen them), large corporate mergers within industries do not increase efficiencies and often lead to higher rents. Does the subsuming entity end up usually with higher or lower stock prices? It all depends… but it doesn’t depend on the state of the US economy. And if a new government regime comes into power in the US that changes rules which move the stock prices up or down… how do we know that the changes are good or bad for the economy at large or for the population at large or for the effected companies’ employees or for any industry or for the population’s grandchildren?

4). To get back around to the point – the economy (including stock markets) is a construct that is supposed to facilitate a nation’s economic growth and stability within the construct of the nation’s rules and regulations. When a nation adds more people to the ranks of the impoverished, maintains an educational/economic system that blocks large segments of the population from being productive/successful, and only rewards a tiny fraction of their population with the “spoils” of market success, it’s farcical to look upon that system and say, “this is good!”

Again, the basic point I’ve made is that we shouldn’t care about anyone or anything’s impact on the stock markets. The impact of policies and regimes on the opportunities and standard of living of the population should be the focus. Stock prices say nothing about these matters. Using the stock market as your baseline metric for the condition of all the participants of an economy is foolish because it ignores too many elements that don’t show up in calculus equations – and have the ability to result in things like Arab Springs and President Trump.

LikeLike