It’s customary at the Passover seder for the youngest person in attendance to ask four questions about why the first night of Passover is different from all other nights. For some reason, at my seder a different question was raised as well: what are bitcoins all about? I guess everybody wants to know about bitcoins now. Well, how embarrassing is that? Not only do I not understand why bitcoins have spectacularly increased in value since their inception (though the current price of a bitcoin is less than half of what it was last December), I don’t even understand why the market price of a bitcoin is now, or ever has been, greater than zero.

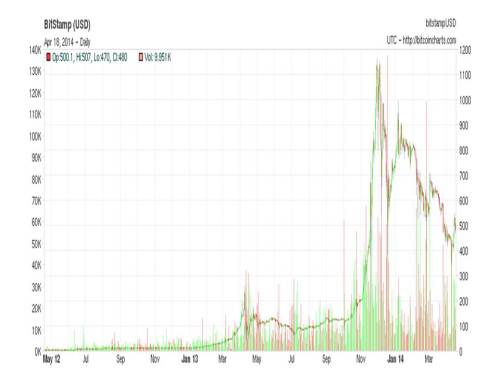

Here’s a chart showing how the value of a bitcoin has soared over the past two years:

Why am I so perplexed about bitcoins?

The problem I have is that bitcoins can’t be used for anything except as a means of payment for something else. Bitcoins provide no real service distinct from being a means of payment. Think about it; if a bitcoin can’t be used for anything except to be given to someone else in exchange, that means that someday, someone is going to be stuck holding a bitcoin with no one left to give it to in exchange. When that happens, that stinky bitcoin won’t be worth a plum (or plugged) nickel, or a red cent. It will be as worthless as a three-dollar bill.

Now I grant you that that final moment of clarity might not happen for a long time – maybe not even for a very long time. But if anything is certain, it is certain that, sooner or later, such a moment must certainly come. But if it is certain that ultimately no one will accept a bitcoin in exchange, then it follows that no one forseeing that inevitable outcome would accept a bitcoin in exchange prior to that moment unless he or she is confident that there is some sucker out there who will accept in the interim. But since when does a theory of asset valuation premised on the existence of an unlimited supply of suckers count as an acceptable theory? Under the normal rationality assumptions that economists like to use, it is not possible to rationalize a positive price for a bitcoin at any point in its history.

So if, as the above chart so dramatically shows, bitcoins are in fact trading at a positive price, how does one avoid concluding that bitcoins are a massive bubble, a Ponzi scheme that must inevitably collapse, as soon as people realize where things are headed? To see just how massive a bubble bitcoins are, compare the above chart to this one constructed by Earl Thompson from actual prices in tulip contracts during the Dutch tulip mania of 1636-37. Compared to bitcoins, the tulips were barely more than a blip.

Now one could respond that if bitcoins are a bubble, then so is fiat currency. That is a pretty good response, and the positive value that we typically observe for most fiat currencies is far from unproblematic. But, as I have pointed out before on this blog (here and here), it is possible to account for the positive value of fiat currency by reference to its acceptability in discharging tax liabilities to the government. The acceptability of fiat currency in payment of taxes is a real service provided by fiat currency that is conceptually distinct from, though certainly facilitated by, its acceptability as payment in ordinary transactions. So, as long as one expects the government issuing fiat currency to remain in power and to be able to punish tax evasion, there is a rational basis for the positive value of a fiat currency. The backward induction argument that establishes the worthlessness of bitcoins does not apply to fiat currency.

Another possible explanation for the positive value of bitcoins is that they are very useful to those wanting to engage in illegal transactions on line, because, unlike other forms of electronic payment, payment via bitcoin is hard to trace. That is certainly a good reason for people to want to use bitcoins in certain kinds of transactions. However, the difficulty of tracing transactions via bitcoin is not an explanation of why bitcoins have a positive value in the first place, only an argument why, if they do have a positive value, the demand for them might be greater than it would have been if it were not for that advantage. Without an independent explanation for the positive value of a bitcoin, you can’t bootstrap a positive value for bitcoins by way of the difficulty of tracing bitcoin transactions.

So there you have it. As far as I can tell, the value of a bitcoin should be zero. But it’s obviously not zero,and though falling, the value of bitcoins is showing little sign of moving rapidly toward its apparent zero equilibrium value. There seem to be only a couple of ways of explaining this anomalous state of affairs. Either I have overlooked some material fact about bitcoins that might impart a positive value to them, or there is a problem with the theory of valuation that I am using. So I ask, in all sincerity, for enlightenment. Help me understand why bitcoins are not a bubble.

HT: Dana Dachman

“Why Bitcoins Aren’t a Bubble”

The libertarian answer would be that the price of bitcoin in bitcoins is not changing.

LikeLike

That is a truism, which tells us nothing about bitcoins.

LikeLike

100 years ago, my grandparents would not have expected a small paper card, with a baseball player’s picture on it, to be worth anything. If that baseball card were also useful for certain trades, then that monetary demand could drive up the baseball card’s price even more. Of course, if some rival money came along, then the monetary premium of the baseball card would be driven to zero, though the original curio value of the card might remain.

You make an important point about taxes backing money, but it needs to be pressed harder. A government whose assets consist of $100 of “taxes receivable” can use those assets to back 100 paper dollars just as surely as a bank with 100 oz of silver in its vault can use that silver to back 100 paper dollars

LikeLike

Bitcoins look like a bubble to me because people are getting involved for speculative reasons and they aren’t used much as a medium of exchange for regular goods. I am agnostic as to whether it will succeed in the way its proponents imagine. Nonetheless, your argument is unsatisfactory. I must admit I winced a bit reading some of your reasoning in this post. You have started with the assertion that they have 0 value and used backward induction to create an argument that is supposed to support your conclusion. If you don’t want to allow bitcoins to have any value then why not ask yourself ‘is it useful?’ You might say it is useful only if it has value. Assuming it has value then it has plenty of features that would make it attractive to people. If multiple people have decided it has value then can it not become a self-fulfilling prophesy? Or would you insist that it is illusory? Compare it to be a multi-player computer game that requires widespread participation for it to be playable and therefore valuable. Also social networks, telephones, chess sets. Of course multiple people may decide it has no value. It has no divine right to be valuable to people. Still, I would like to know why the collective decision of people that something has value is not just wrong but completely wrong. You seem to be saying it has to have zero value for some existential reason.

LikeLike

If bitcoin was created as part of a business venture to fill the market need for an anonymous means of electronic payments then could not the bootstrap process that initially gave them value have been engineered as part of the business plan ?

At the simplest level bitcoins backers could have initially intervened directly to create a market for them, by for example anonymously buying up the initial batches of mined bitcoins at a non-zero rate of exchange against a real currency. They would have to continue to do so until people have enough confidence in its value to start to really use it for anonymous electronic payments. (If you agree to accept payment in bitcoin then you really just need to know that you can convert it into conventional money at an acceptable rate as soon as possible after your payment comes through, you probably won’t plan to hold them)

From that point on bitcoin would have genuine value based on its usefulness in anonymous transactions compared to other means of payments. I do not see its value as being based on a bubble any more than a conventional fiat currency whose value is derived from it use a a form of taxation settlement.

LikeLike

Hi. I set out some thoughts in response to this here: http://laeeth.com/podcast/?p=349

LikeLike

Bitcoins have value as a cheap (10 cents or so) way to send money nearly instantaneously to anyone in the world (as opposed to 1-3 days for wire transfers at around $20-30 a pop). They also might have considerable value for the “unbanked” population in poor countries (similar to M-pesa being used in Africa).

LikeLike

Eli Dourado has a nice detailed article about the potential non-monetary uses of Bitcoin (e.g. distributed contracts, smart property, betting/prediction markets).

http://theumlaut.com/2014/01/08/bitcoin-internet-of-money/

LikeLike

In general I agree with your post, David. However, if the government ceased accepting dollars for taxes I doubt the US dollar would fall to zero, given the wealth of assets on the Fed’s balance sheet that could be dispatched to repurchasing unwanted dollars.

Mike’s point about bitcoin as baseball card runs into one problem. Bitcoin are almost infinitely divisible. One can satisfy one’s demand for bitcoin by holding 1 bitcoin or .0000001 bitcoin. A baseball card, on the other hand, loses all curio value once one starts to cut it up into pieces.

While distributed contracts etc might add some non-monetary value, I don’t think that this can be an explanation of why bitcoins had a positive value in the first place, since those features were not being talked about back in 2009.

LikeLike

Rob, you wrote:

“If bitcoin was created as part of a business venture to fill the market need for an anonymous [as well as cheap and fast] means of electronic payments then could not the bootstrap process that initially gave them value have been engineered as part of the business plan?”

Reminds me of XRP in Ripple, which as JP explained, was given positive initial value as a chartal currency (users are required to have a minimum XRP balance to make ledger entries and extend lines of credit to other users, and XRPs are required to make transactions).

http://jpkoning.blogspot.kr/2013/03/birth-of-currency-welcome-to-world-xrp.html

Although JP disagrees with me about the viability of the plan, Ripple’s founders have explicitly stated that they will rely on XRP appreciation for profits, at least in the short term.

“Though the company is giving away many of them to get the system off the ground, it has allocated one-fourth of the hoard to itself and is relying on the XRP’s increasing value as its only source of income.”

http://www.technologyreview.com/featuredstory/524566/making-money/

LikeLike

bitcoins started out being pretty much worthless – you could “mine” them with a very low powered CPU – because there were not many transactions and the algorithm takes into account how much CPU power is being used by all bitcoin transaction validators (miners)

now, bitcons are worth what it costs to mine them though those who can leverage more capital can operate at lower margins and so reap a profit

those miners also reap small gains form transaction costs – what those who wish to see speedy processing of their transactions pay to ensure it

bitcoins have a speculative element about them that is very true – i can not say to what extent people obtain them for this reason

bitcoins were jumped on by Chinese who had money they wished to have the power to remove from China though China has made this much more difficult

i did not know what bitcoins were all about until i obtained a small amount which i then transferred to myself – without the help of a bank and with no barriers – no national or sovereign boundaries, no middle men other than the internet of bitcoin users

that experience brought it home to me instantly and i felt mightily empowered

bitcoins value is in its power to impress people once they use it for the first time – because i do not know of anyone who has tried it, with a little of their own wealth, who was not likewise impressed

so, right now they have a value based on the cost to produce them plus a value as perceived by those who see what they can do plus a bunch of people so impressed that they speculate that their worth will at least not be much less than it is now

will bitcoins be around in a year?

who can say

but if they are and if they survive more years after that then their value will be like the value of anything else that people value

because though gold’s value might ultimately be that it can be used to make pretty things, it’s real value is simply that people value it

and nothing more

pop

LikeLike

David @”April 18, 2014 at 11:45 am”

Yes of course. My point was that the believers of Bitcoins (and I am not one of them) will see it that way and for them that is the answer.

LikeLike

I don’t understand your “zero value at some point in the distant future” argument. Suppose that (between now and the end of time) each year there was a 1/1,000,000,000 probability that Bitcoin would collapse. If the services provided by Bitcoin are far higher than that figure, why should anyone care about its possible collapse?

LikeLike

“Is Bitcoin a bubble?”…yes the mother of all bubbles !

LikeLike

what is the price of a coordination equilibrium? why would it be expensive to purchase rights to the name “facebook.com” in the DNS system, when innumerable alternative strings of characters would be nearly free, and when, someday, the string “facebook.com” will certainly be forgotten?

the value of a coordination equilibrium is related to the value of the activities being coordinated, and limited only by the price of establishing an alternative coordination equilibrium. it’s that last one that confuses people. the locus of a coordination equilibrium is a priori arbitrary, after all. if we have agreed to hold a market under the buttonwood tree, why is it so hard for someone else to come along and redirect us to the maple tree?

but, in some times and places it is hard. in particular, once a coordination equilibrium becomes established, displacing it requires the simultaneous redirection of a substantial fraction of the community that coordinates around it. persuading an individual to be transiently redirected has some cost. persuading many individuals at approximately the same time may be very costly (or may require finding some form of value associated with the new location that breaks the arbitrariness of the coordination equilibrium). facebook could sit on its laurels and be pretty safe, ‘cuz jumping ship en masse is hard. but the company works really hard to create value at its site, to discourage any potential bias towards mass redirection by virtue of more value elsewhere.

bitcoin is an arbitrary locus of exchange, a buttonwood tree. there is nothing whatsoever special about it, other than it is one among a potential infinity of similar schemes that “works” to enable low-cost international money exchange, pseudonomous purchase of who-knows-what, a gambling device, and the hope of all kinds of cooler, fancier, services someday that Eli Dorado et al write about. it offers real value to its users already, because as some commenters have already pointed out, determined pioneers established initial conditions under which it could serve those purposes. they bootstrapped nonzero value, and rendered it familiar and therefore a natural choice among people hoping to coordinate bitcoin-coordinable activities.

the activities that something like bitcoin could eventually help coordinate are in fact hugely valuable. given that, and stipulating its continued hegemony as the buttonwood tree, the value of “a” bitcoin becomes an inverse function of the velocity achievable in performing its useful functions. how “much” bitcoin do users have to hold, to, say, participate in automatically enforced electronic contracts or buy and sell dildoes conveniently? given that there is a large potential fundamental value to bitcoin (if the schemes we invent require people to hold some buffer stock and therefore limit velocity), but great uncertainty about that value, the technological conditions that will in part determine that value, and the stability of the coordination equilibrium that renders bitcoin distinct from an infinity of alternative schemes, bitcoin is understandably and not unreasonably a volatile asset, but one with legitimately positive value.

re backwards induction — an asset whose terminal value is zero but which offers a convenience yield prior to termination is not worthless. there is are opportunity costs to the arbitrage you presume is possible so long as bitcoin mediates activity people find useful and a buffer stock of the stuff is required. why, in the good old days, did banks hold reserves at an opportunity cost of several hundred basis points? sure, the face value of the reserves can be rationalized as tax-offset coupons, but the opportunity cost paid was offset by a convenience yield (hi JP!) not unlike the convenience yield bitcoin offers to some users IFF it remains the hegemonic asset of its type and transactional frictions meaningfully limit velocity. since the date of termination is indeterminate and perhaps very distant, the cost of decay to termination may (or may not) reasonably be thought small relative to expected convenience yields.

in practical terms, i think the big question mark is the uncertainty of bitcoin’s continued hegemony, as it may be challenged by technically superior alternatives and cannot very easily evolve and redefine itself to match superior upstarts.

LikeLike

agree 100 per cent

LikeLike

But it will probably take the next general market crash to get it out of the way

LikeLike

Why would it be zero, so long as I can exchange it for goods and services? I think its better to think of this as an exchange rate, not a fundamental value. If I can wire my friend in CA bitcoin to pay for beer, and its cheaper, bit coin will be valuable. The exchange rate would be 1:1 +/- some percent. Given that ThomasCrook charges 10% for currency exchanges at the airport (look at the bid-ask) it seems like a potentially cheaper way to transact. Credit cards, Visa can take up to 3% off the top.

Also, I have read that bitcoin is used in the underground economy – drugs etc. to avoid shoe leather costs associated with actual cash, along with circumventing the banking system and money laundering provisions. I need to add a disclaimer: I do not know this firsthand, and even if I did it would be a felony for me to tell someone how to do this. Nevertheless you can read this:

http://money.cnn.com/2014/02/14/technology/security/silk-road-bitcoin/

So, it seems to me bitcoin has some transactional value as currency.

So, what would the exchange rate be? I think (check) bitcoin is only created at some small rate. Think of it as a fixed stock of currency, like gold. The exchange rate should be governed by the rate of change of the bitcoin supply. net inflation in the set of products for which bitcoin is used (i.e. drugs), vs the overall dollar inflation rate. So, lets say there are 25 mil bitcoin transacting 1mil bags of heroin with a street value of $50/bag. I expect the exchange rate to be about 2:1. If heroin doubles ($/bag), I expect the exchange rate to double. This is simplistic, but you get the idea.

As to your point about ” that means that someday, someone is going to be stuck holding a bitcoin with no one left to give it to in exchange.”

First I think you are questioning whether its a good store of value. When its no longer useful as an exchange medium, the exchange rate should be zero. Probably not a good store of value, I agree.

However, so long as there are people willing to transact bilaterally in illegal stuff looking to avoid the banking system, I do not think its an issue, and the exchange rate should be positive. There is always a market for untraceable money. Someone sits in the middle with feet in both countries like Thomas Cook willing to exchange the bitcoin for local currency, or diamonds, or something else (aka money laundering). If I were a drug dealer and I did not pay my supplier, or left them holding the bag, the penalty would be pretty severe.

I am not saying *all* of the exchange value of bitcoin is tied up in underground markets, but I suspect a lot is, or they would not be running bitcoin servers in countries with no extradition. .

LikeLike

“like Thomas Cook” I did not mean Thomas Cook is actually doing the exchanging of bitcoin … I mean some entity that performs the same function in the bitcoin market that Thomas Cook does in the currency market.

LikeLike

Gold as a financial asset has the appealing property of being a liquid financial asset that is not someone else’s liability (which is important at a time when credit risk comes to the fore). Also, if you hold it directly or somewhere pretty safe (a bank vault in Singapore?) it’s hard for someone to seize, which isn’t the case for a regular bank or brokerage account. And there are no chargebacks. In countries that are rather less politically stable and more disorderly than the US of 1900 (and also the US of today), this has much more value than someone who lives in the West might appreciate.

Bitcoins are not as strong as gold in this respect, but it’s the closest of any other financial asset I am aware of (abstracting away from the teething problems that typically characterize any new invention).

One shouldn’t place too much emphasis on how the early adopters of bitcoin have darker uses for it. This is rather commonly how technological innovations proceed (think of the videotape and the kinds of movies that people most appreciated watching in private), and can be thought of as related to the Ibn Khaldun/Toynbee point that creativity comes from the fringe; or from the “Innovator’s Dilemma” thesis of Clayton Christensen. These things always start at the fringe, and in niche markets and at that point the bugs are worked out, preparing for eventual more mainstream adoption.

I have written a few more thoughts on this here:

http://laeeth.com/podcast/?p=349

People tend to treat the behaviour of financial assets during a particular period as representing intrinsic qualities of the asset rather than as being shaped by the experiences during that particular time – and these may or may not repeat themselves in the future. Every equity market is kind of psycho in the beginning – look at the Baltic States, or Mongolia. But over time as there are more, and more sober participants this tends to settle down. So I would be cautious about expecting that bitcoin will always trade in this manner.

Bitcoin is not an equity, but similar effects may apply. In particular the rally to recent highs was driven by investment flows of a more medium term nature. In a small market this is bound to lead to something of a squeeze in the near-term, and it’s not surprising these were far from perfectly timed from a short term basis. But on the other hand these investment flows are exactly the kind of thing that happens as part of a market becoming more serious and institutionalized, and one should look at the situation in the greater context.

One final point is that if inflation – contra the current views of our host here – were to pick up, slowly in the beginning, and then quickly, bitcoin is likely to be seen as an asset having attractive portfolio characteristics (in price and non-price terms).

Something not many have discussed is the influence of real rates on bitcoin valuation. Today, real rates are extremely low everywhere. Perhaps this might change (and I think it will). As real rates rise, this may be a little more challenging for bitcoin (again, one is reminded of the similarities to gold).

LikeLike

i looked into the silk road thing

what i found was that it looked to me that all of the advertisers there were under cover law enforcement types

like the whole thing was one huge honey trap and all the free advertising they were getting every time the MSM talked about bitcoin they never failed to say it was anonymous and they never failed to say it was used by drug dealers and terrorists

i find that very very hard to believe

the only people i know who have bitcoins are computer nerds who mostly work for banks and governments

p

LikeLike

JP:

Interesting point about divisibility. But change analogies from baseball cards to gold, and the divisibility problem goes away.

LikeLike

For the same reason that strips of green paper aren’t a bubble – efficiency. Bitcoin provides the means to simplify the exchange of goods and services in a way that cannot be accomplished today. Markets tend toward efficiency in the long run, and paper currency has obvious limits, a couple of which were pointed out by JohnS.

Electron is more efficient that paper – this is the reason you document your thoughts at uneasymoney.com and not tree bark and charcoal.

IMO electronic currency is inevitable … just as long as we tacitly agree on which otherwise useless electrons will be *the* currency, all is well. David Andolfatto had some interesting thoughts on Bitcoin:

[audio src="http://media.bloomberg.com/bb/avfile/vodRDepeXJso.mp3" /]

LikeLike

Everything is guaranteed to not have value in the sufficiently distant future: entropy death and all that. I hope that was a better rejoinder than “in the long run we are all dead.” So gold, dollars, and bitcoin are not distinguishable that way.

Also, if fiat currency is backed by the power to punish tax evasion (if you don’t use the dollar, you will be punished), anonymous currencies are “backed” by the power to punish illegal acts when conducted in other currencies. If you don’t use bitcoin, you will be punished.

Bootstrapping a thing without intrinsic value is easy. Every Ponzi scheme does it. What Ponzi schemes don’t do is provide ongoing value after the bootstrap — the ongoing value is highly contingent and falls quickly to zero when the schemer can’t redeem. Bitcoin provides lots of ongoing value.

People want to believe. There’s a big difference between things that justify belief, like index funds, and things that don’t, like Ponzi schemes. Offering good features as a medium of exchange, like anonymity and escape from bank inefficiencies, is enough to justify belief. Or anyway it surmounts your argument that bitcoin is a Ponzi scheme.

LikeLike

There is no information from the future. So, the “in the end there will be no-one” point only affects me if it affects the person(s) I am intending to exchange with. If I have no information about when that will occur (not merely if, but when) then it is not a factor in current exchanges because it is not part of current expectations. It is not a risk, because there is no information to quantify it. It is, at best, part of “background uncertainty”.

Think of Confederate $. As the probability of the Confederacy ceasing to be increased, the (at least roughly quantifiable) risk of there being no one to trade with in C$ increased dramatically, hence the value of the C$ plummeted, its “velocity” increased towards 0 and the price level towards infinity. But there was information to base specific expectations on and the risk could be quantified (and clearly was).

Which is a slightly more long-winded way of agreeing with Scott Sumner.

LikeLike

To put it another way, the certainty of occurrence at some no-specific-information-about time does not, of itself, constitute a likelihood of occurrence within the frame in which current expectations are formed and decision calculations are made.

And yes, that applies to all such “regress from certain to happen but-no-specific-information-about-when” arguments.

LikeLike

Actually, I meant the reciprocal of velocity–i.e. the time money was held between transactions headed towards 0. I try and express it all better here:

http://lorenzo-thinkingoutaloud.blogspot.com.au/2014/04/there-is-no-information-from-future.html

LikeLike

to interfluidity

very clever way to present bitcoin – in a bitcoin modeled story

bravo

p

LikeLike

David!

Bitcoin already is a bubble(despite Gene Fama having a real problem accepting the word ‘bubble’). Keep everything on one side, just look at what happened to Mt.Gox, a bitcoin exchange. It recently applied for bankruptcy. Like all bitcoin bugs, people behind Mt. Gox also thought that there is only one way for bitoin: up. But, as classic bubble phenomena goes, its price rose suddenly and came crashing down suddenly! This also exposes another facet of why bitcoing would make lousy money; its value goes through drastic swings, something one wouldn’t want to happening to currency he or she holds. I certainly wouldn’t want the value of currency i hold to have that kind of uncertainty.

Why does bitcoin retain its value? To me, there are two dominating factors at work here (besides many): the ability to ‘print’ money without any regulation (no government here) and a bit of doomsday scenario concerning the dollar. Mining bitcoins gives that lovely feeling of freedom, from government control. You can mine and own as many as you want. Think about this a bit further, and it is same as pursuing one’s won self interest. Unfortunately, this is not the Smithian self interest that promots well being of the society! I saw a report recently which carried numbers taht suggest that to mine 10,000 worth of bitcoins, society uses up double the amount of electricity (i am not exactly quoting the same numbers, but the point is the same). Thus, unknown to bitcoin bugs, their pursuit of self interest is is hurting the economy rather than helping it.

The doomsday scenario relates more to the subpar performance of the economy, an the slide in dollars value against other currencies. In this scenario, the case of increase in bitcoin’s value is the same as increase in Gold’s value. Goldbugs kept telling that dommsday is coming, when dollar will crash and only valuable currency will be gold. Similarly, bitcoin also provides a good alternative (at least to bitcoing bugs) in case of a doomsday scenario.

I believe the above two contribute significantly to the positive value of bitcoin. And i also believe that it’ll be some time before the euphoria goes away.

LikeLike

One perspective is that bitcoin in an option. The distribution may be mostly zero right now, but as long as some probability of exchange at greater than zero exists, then it has positive value.

You can find equities on bk companies that are certain zeros, yet the equities continue to trade with option premium.

Another perspective is that the only defining characteristic of bitcoin is limited supply. Therefore it’s market price is a pure measure of the value of exclusivity.

As for whether it is a bubble, that would depend on whether people are borrowing to buy in size. Only then can a small decline in price be leveraged by margin calls into a catastrophic decline.

LikeLike

Good tradintional valuation analysis but it does not apply to bitcoin because of the transformaiton fo society to digital. For example, how would you pay for a digital candle in a church in a virtual reality? http://www.digitalcosmology.com/Blog/2013/01/15/digital-religions/

LikeLike

I am even worse than David G.

I can’t even understand how bitcoins ever even became a bubble, let alone if they are a bubble now.

What is there to bubble?

And making payments by Paypal is easy.

Yes, a dollar has value as you can pay taxes with it, so most other people will accept a dollar.

A bitcoin? If bitcoins are a collectible (like Warhol paintings, old baseball cards, stamps) the tactile and visual rewards appear below zero.

I assume bit coins will become worthless soon. It may be there is a “need” for a payment system that evades detection by authorities, and that raises a whole ‘nother kettle of fish.

David G. had a better seder than I did, judging from the topics raised.

Mom gave me two shirts. I wore one. “Whatsa’ matta, the other shirt not good enough for you?”

LikeLike

Bitcoin is the right reaction of the public to the monetary despotism of the governments and the banks who have monopoly to create money, even if its value is nothing else than a convention agreeable to people who use it. Today all the money is virtual and the very best prove to it is the quantitative easing policy of federal reserve bank. It increased the monetary base (or what is the real money and not credit money in the economy) from less than 1 trillion at 2007 to almost 3 trillion at end of 2013. And what happened to the inflation? Practically nothing. It seems, the inflation level is more influenced by the general mood of potential creditors and borrowers, than by amount of money printed by the federal reserve. At the end of the day most of the money in the economy is not from printing machine of the government but of the credits the commercial banks give. If this is not virtual money so what it is? And still people trust the money and use it as sole instrument to make economic transitions. The same is with the bitcoin. If people decide to give trust to this virtual money it will have value. In the past the trust of people in the currency was supported by the Government, who strictly guarded their monopoly to create money. They have done it by using force and also collecting the taxes in the local currency. To day it is not so obvious anymore.

LikeLike

Mike, I think the difference between a bitcoin and a baseball card is that people are willing to pay for whatever real service flow is generated by the baseball card without any expectation of resale. If the only service offered by an asset is its resale value, I don’t understand how an expected positive resale value can be sustained. The point about acceptability in payment of taxes is that that provides a real service flow independent of the resale value of the currency. Without that I don’t see how currency retains a positive value either.

Pete, I am saying that the only service out there that the bitcoin is providing is its resale value. Obviously bitcoins have a positive value now. I don’t dispute that. Tulips had a positive value in Holland in 1637. The question I am posing is simply this: Can this value be sustained. The backward induction argument suggests that it can’t, just as the high value of tulips could not be sustained in Holland in 1637. The value of a chess set does not depend exclusively on its resale value. The fact that a durable good can become obsolete and lose its value does not mean that people were not receiving real and valuable services from it while they owned it. What is the service provided by a bitcoin? The only service it provides is the expectation of resale.

Rob, I think that you are only explaining how the bubble got started. I am asking why the bubble is not bursting. Anonymity in transactions is great, but anonymity is worthless unless the underlying asset is valuable. Where does the value of a bitcoin come from? From the its expected resale value? What makes the expected resale value positive?

Laeeth, Thanks, I haven’t yet had a chance to read what you wrote, but I hope to do so soon and perhaps respond then.

John S, Again, the nice features of a bitcoin can be simply wonderful, but they are entirely contingent on the expectation that the bitcoin will a positive future resale value. Where does the future positive resale value come from?

Thanks for the link. I will check it out.

JP, I don’t know what a distributed contract is, so I will have to find that out before I can respond fully. You make a good point about the dollar and the Fed balance sheet, which could account for an expectation that the Fed will use its balance sheet to retire dollars. But if dollars were no longer acceptable in payment of taxes, I think that there would be a huge effect on the value of dollars. I think that the confederate dollar started losing value rapidly when the outcome of the civil war became clear, not because of an increase in the quantity of confederate currency.

The Peak Oil Poet, The high cost of producing an asset cannot give an asset value. Only an asset with a high value will be worth incurring the high cost of producing it. Again, I don’t think that you are responding to my query which is what real service does a bitcoin provide that is distinct from its expected resale value?

I will try to respond to other comments later today.

LikeLike

“Where does the value of a bitcoin come from? From the its expected resale value? What makes the expected resale value positive?”

I’m seeing it like this:

People who transact in BTC may have no desire to hold them. As long as BTC has a non-zero value and good liquidity then transactions will be possible. The buyer buys BTC and sends them to the seller who immediately sells them. This can take place very fast and minimize exchange-rate risks for the seller. BTCs backers may need to have some control over the exchanges initially to ensure a non-zero value and sufficient liquidity.

Even if no-one had any interest in holding BTC for anything other than transactions it could have a non-zero value. Its demand will be a function of the volume of BTC transactions taking place. If the number of BTC transactions increases sharply but its supply is fixed (or grows slowly) then this would explain its increasing value.

In addition to this transactional demand there is clearly a speculative demand too. This speculative demand could well be a bubble as far as I can see.

LikeLike

Ramanan, Good point, but I am guessing that there may be more sophisticated arguments out there than that one.

Scott, The argument suggests to me that the probability, if expectations are rational, of a collapse is a lot higher than the one that you are positing. It is known with certainty that the value of a bitcoin must go to zero, and the entire value of a bitcoin is derived from its expected resale value. Aside from its expected resale value, I am supposing — and you are not challenging my assumption – bitcoins provide no real service that would confer any value on it. If its value must certainly go to zero, the backward induction argument is pretty powerful and the value should go to zero pretty fast. The backward induction argument, by the way, is not an exotic one. It is a pretty standard argument in dynamic programming and game theory.

don, I think we are in agreement.

Interfluidity, I interpret the first five paragraphs of your interesting comment to be a cogent explanation of the network externality associated with using an agreed upon medium of exchange. I think I agree with most if not everything you say in those paragraphs. Where we may be in disagreement is the backward induction argument. The way I interpret your comment on backward induction is that a small deviation from rationality sufficient to create a positive value for bitcoins may have generated enough demand for bitcoins as a medium of exchange to maintain an ongoing demand for bitcoins based on the liquidity or convenience services that it is providing, so that bitcoins can sort of levitate in mid-air defying the gravitational pull of the ultimate worthlessness of bitcoins in the end state. It seems to me that, if you are right, then there is a pretty substantial risk of a bitcoin crash. There has been a substantial increase in demand for bitcoins over the past couple of years. I think it likely that the increase in demand for bitcoins will taper off eventually. That increase in demand may have been what kept the value of bitcoins increasing. When the demand for bitcoins stops increasing, what will prevent the crash from starting?

JKH, We shall see, but I am content to wait it out for the next general market crash.

dwb, Obviously as long as you can exchange it for goods and services, its value is not zero. That is a truism. The question is why anyone will accept it in exchange for any valuable asset, good, or service. That is the question everyone (but Interfluidity) is begging. Paper dollars are popular in the underground economy, but we have an explanation for why dollars are valuable (at least I think we do). Paper dollars are costly to transact with, so there is an incentive to use a substitute for them, but those substitutes are even more costly for illegal transactions. Bitcoins economize on those costs, but the value of bitcoins must be explained not assumed. That’s all I am asking for. I have an argument for why the value of a bitcoin should be zero, but I am not saying that the argument is conclusive, just that you need another argument to overcome my argument.

laeeth, Your observations about gold are very astute, as usual. And I see the point of similarity between bitcoins and gold, though, in all honesty, I must admit – actually it’s a matter of public record as anyone can see by searching this blog – that I think that there is a bubble in gold. And I also agree that one should not be entirely dismissive of bitcoins just because they are widely used to finance illegal transactions. But again I come back to my question what gives bitcoins any value in the first place if their services are totally derived from their expected future resale value and that future resale value must eventually and certainly be zero?

Dustin, Well, I have a different explanation for the value of green paper. I think you are probably thinking along the lines of Interfludity and I agree that it is a possible approach to explaining the value of bitcoins, but, for reasons that I have been repeating over and over again, I think it is a fragile explanation. Thanks for the link to Andolfatto.

polymath, You said:

“Everything is guaranteed to not have value in the sufficiently distant future: entropy death and all that. I hope that was a better rejoinder than “in the long run we are all dead.” So gold, dollars, and bitcoin are not distinguishable that way.”

Again to repeat myself, the issue is not that the terminal value is zero, the issue is that the service provided by the bitcoin is entirely derived from its expected resale value and the resale value must certainly go to zero. All the other assets provide a real service independent of its expected resale value.

What is the interest of illegal transactors in conducting transactions in bitcoins if the value of a bitcoin is zero? Again you are assuming your own conclusion. Bitcoins only provide ongoing value if they are valuable, why are they valuable is their value is derived only from an expected resale value that is guaranteed to eventually be zero?

Lorenzo, I hear what you are saying. But if the service provided by a bitcoin is derived totally from its expected resale value, I don’t think that you can simply posit that people disregard the fact that the resale value must eventually be zero. Perhaps they in fact do that, but then must at least acknowledge that there is an antinomy that has to be resolved.

Shahid, So far, I think that you an Interfluidity have provided the best explanations for what is going on. I lean toward your explanation, but I am really just guessing. Interesting point about the real resource cost associated with “mining” bitcoins.

cfaman, Good point about bitcoins as an option. Not so happy with the limited-supply point, however. There is was a limited supply of garbage in front of my house this morning when the trash was picked up. That didn’t confer a positive value on it. The garbage was given away, not sold.

DigitalCosmology, Sorry, but I’m not getting your point.

Benjamin, Hope your seder next year is more interesting.

EugenR, There’s still a basic difference between bitcoins and electronic dollars, which you have not explained away.

LikeLike

David – since you live in the States there may be certain regulatory problems with actually doing this.

Nassim Taleb has spoken about the problems of Stiglitz syndrome with public intellectuals. I have a great deal of respect for you, and would not put you in that category.

At the same time, it’s easy when forming an opinion about liquid markets with a speculative component to them to become convinced of the certainty of one’s opinion being correct, and not experiencing any pain whatsoever when proven wrong. (Since one can always explain the failure of a pattern prediction by pointing to some new factor not captured in one’s model).

Spot bitcoins today are 492.74. There is no market for borrowing bitcoins that I am aware of, but presuming a zero own-commodity interest rate (not unreasonable), one can imply a forward price for April 2015.

What is your midmarket expectation for that time?

At what price would you in theory be willing to purchase a 20 delta put on bitcoins vs USD?

LikeLike

In response to David:

“a small deviation from rationality sufficient to create a positive value for bitcoins may have generated enough demand for bitcoins as a medium of exchange to maintain an ongoing demand for bitcoins based on the liquidity or convenience services that it is providing, so that bitcoins can sort of levitate in mid-air defying the gravitational pull of the ultimate worthlessness of bitcoins in the end state. It seems to me that, if you are right, then there is a pretty substantial risk of a bitcoin crash”

but why are you so sure that the end state of bitcoin is zero? as interfluidity points out, we have seen so many instances of value creation by businesses that are easy to replicate with a time machine, but hard to do so today. why is the NYSE or CME worth a penny? because it’s where people transact, and they are happy to pay more than marginal costs + amortized costs to replicate because it’s convenient to do so. why does any franchise have value? (i do appreciate the distinction between enterprise value in a company, and the current pricing of a medium of exchange – but the similarities of the effects are more important than the distinctions right now).

“I think it likely that the increase in demand for bitcoins will taper off eventually. That increase in demand may have been what kept the value of bitcoins increasing. When the demand for bitcoins stops increasing, what will prevent the crash from starting?”

why would demand taper off? what kind of marketshare of global financial and economic transactions does bitcoin have today? what could it be in the future? at the risk of sounding like the guys who said “if we could only sell our product to 1% of chinese people”, don’t you think there are quite realistic scenarios where people’s involvement in this instrument continues to grow rather substantially? if not, shouldn’t you take the time to set out the case in a well-argued manner rather than just assert it.

“The question is why anyone will accept it in exchange for any valuable asset, good, or service. That is the question everyone (but Interfluidity) is begging”.

I bought something that cost GBP100 via bitcoin the other day, since bitcoin price was cheaper.. I ordered a bit too many bitcoins, but really I am hardly worried about the currency risk on the balance. Maybe they will go to zero, but really who knows, and I rather think not. For most people the absolute magnitude of fluctuations in their bitcoin balances is rather small in comparison to wealth, and also the utility services provided by bitcoin. Of course other holders have more substantial balances – perhaps criminals, but also investment firms, for whom this asset has nice portfolio characteristics.

” Paper dollars are popular in the underground economy, but we have an explanation for why dollars are valuable (at least I think we do)”

Knapp vs Menger+Mises. Bitcoin certainly tends to make one think Menger had a point.

(You talk about this here: https://uneasymoney.com/2012/08/19/where-does-money-come-from/ )

See:

http://www.forbes.com/sites/jonmatonis/2013/04/03/bitcoin-obliterates-the-state-theory-of-money/

)

“the value of bitcoins must be explained not assumed. That’s all I am asking for. I have an argument for why the value of a bitcoin should be zero, but I am not saying that the argument is conclusive, just that you need another argument to overcome my argument.”

I am reminded of the old joke that an economist is someone who sees something working in practice and asks if can work in theory!

“I must admit that I think that there is a bubble in gold.”

So I understand. I turned bearish Gold sep 2011 and was short it in the first part of 2013 on the basis of impact of rising real rates and extreme mass psychology. I think it’s okay here given rising inflation and a massive shakeout. What would you say are the strongest arguments to justify the term bubble as applied to gold?

“my question what gives bitcoins any value in the first place if their services are totally derived from their expected future resale value and that future resale value must eventually and certainly be zero?”

well you presume what you ought to prove, I think. bitcoin’s supply is limited, and the user base so far continues to grow (and I have suggested this might only be the beginning). in the event the price collapsed to 1% of its present value and yet people still continued to use it (and the user base continued to experience growth, as it has done since inception) it seems highly unlikely it would stay there for long given the appeal of scooping up something that is limited in supply and for which balances are held for transactions purposes, where the underlying demand is growing, and that may have attractive portfolio characteristics.

”

Again to repeat myself, the issue is not that the terminal value is zero, the issue is that the service provided by the bitcoin is entirely derived from its expected resale value and the resale value must certainly go to zero. All the other assets provide a real service independent of its expected resale value.”

Again – why must the resale value go to zero? And also, its usefulness is not as a unit of account, or store of value. Its usefulness is as a medium of exchange – so it is a strange way of speaking to say that the service provided is entirely derived from its resale value. The service provided is derived from the fact that other people accept it and that it has certain unique characteristics.

Imagine volatility were to multiply 20 fold, making it a hazardous venture indeed to transact non-simultaneously in the currency. Why, I am quite certain that entrepreneurs would arise who would offer bitcoin facilities where you could hedge your currency risk into your home currency so that the volatility did not affect you. The fact that nobody has done this reflects certain problems of organisation and regulation to be sure, but it also reflects the fact that this is not really a major problem for most users. (Silk Road offered this service, and what happened afterwards demonstrates some of the problems of custodial services that will have to be addressed. But I see these problems as teething pains, and nothing more).

“What is the interest of illegal transactors in conducting transactions in bitcoins if the value of a bitcoin is zero?”

The value of a bitcoin is really irrelevant – it’s change in the value between the time you bought them and the time you sell them that matters. Hence my point about volatility and likely entrepreneurial adaptations above.

“cfaman, Good point about bitcoins as an option. Not so happy with the limited-supply point, however. There is was a limited supply of garbage in front of my house this morning when the trash was picked up. That didn’t confer a positive value on it. The garbage was given away, not sold.”

The use value of garbage was zero to negative. The use value of bitcoin is not zero…

LikeLike

David — Sure. There is a big risk of a bitcoin crash! But also the real possibility of its continued stability. It’s really is very much like the “network effects” surrounding facebook or (not so long ago) the Windows operating system. Remember, lots of people thought that the Windows operating system was outright inferior to technically feasible, even commercially available, alternatives. Let’s suppose that’s right. Then, in a sense, its “fundamental value” was less than zero. Yet the network effects created a very large barrier to “finding its true value”. So long as the “deviation from fundamentals” remained, so did real value from using Windows over using event superior alternatives. Maybe Windows is now reverting to form, that is dying in favor of superior technologies. Maybe facebook is too. But, even with the benefit of hindsight, it’s been perfectly rational for users to enjoy the benefits derived from network effects of those eventually doomed technologies. The noisy reversion to fundamentals, amortized over time, turns out to have been a modest cost of doing business.

If bitcoin crashes to zero tomorrow, we won’t tell the same story. But if its current hegemony in the service of low-cost funds transfers and greymarket purchasing fades only slowly, there will never have been any kind of bubble at all, even as the value of bitcoin eventually drops slowly to zero.

I don’t know whether bitcoin will crash soon, fade slowly, or remain valuable for indefinitely. But it will only have been a bubble ex post if it crashes abruptly and soon. Ex ante, given that fading slowly or surviving indefinitely remain reasonable possibilities, its nonzero value can’t be termed a bubble.

(Some prices for Bitcoin might imply a bubble, though. Stipulating BTC as a durable Schelling point, there is a “fundamental value” related to the aggregate value of services provided and the stock of bitcoin required to perform those services, both of which are uncertain but conceptually quantifiable. If the “market cap” of BTC is higher than that, that would be a price bubble.)

LikeLike

I agree with BC is a Bubble. What I don’t understand is why Austrians pretend demonstrate that is a money. I think that they are strongly mislead by their paranoid priority on stability of money value as only source of progress, when the priority stability should be more ample.

LikeLike

David, I must confess that I don’t understand how Confederate dollar example applies, though I’m familiar with the episode.

Say that in 2015 the US Treasury will only accept gold in payment of taxes. In general, people will choose to hold fewer dollars and a bit more gold. However, as unwanted paper dollars get brought to banks, and these banks in turn ship unwanted notes to the local Fed to be converted into reserves, the Fed will surely withdraw the excess. If it doesn’t, its price targets will be violated. Thanks to the Fed, I don’t see how the dollar can’t survive a loss of tax acceptability.

LikeLike

You could make the same argument for any currency. There will come a day when dollars are no longer accepted anywhere – so why give them any value now? Every fiat currency in history has collapsed.

Study up on the nature of money and you’ll get your answers.

Learn about bitcoin and how it works, and you’ll see why it’s far superior to government-issued fiat currencies.

LikeLike

David, I have had another go at explaining why I am fine with saying the value of bitcoins is highly unstable, but don’t like the “regress from future certainty” argument.

http://lorenzo-thinkingoutaloud.blogspot.com.au/2014/04/bubbles-bitcoins-and-decision.html

LikeLike

Hi.

Milton Friedman’s 1953 essay on positive economics (http://digamo.free.fr/hausman82.pdf#page=76) continues to exert an influence on the field, although there is today greater emphasis on micro-foundations.

“The ultimate goal of a positive science is the development of a “theory” or

“hypothesis” that yields valid and meaningful (i.e., not truistic) predictions

about phenomena not yet observed. Such a theory is, in general, a complex

intermixture of two elements. In part, it is a “language” designed to promote

“systematic and organized methods of reasoning.”5 In part, it is a body of

substantive hypotheses designed to abstract essential features of complex

reality”

Dr Glasner and some other commenters here hold the belief that bitcoin is a bubble. The point about a bubble is that it eventually bursts, and the old highs are not seen for many years to come.

So suggesting that bitcoin is a bubble implies a theory of bubbles and a set of beliefs about bitcoin that relate to this theory.

If we do not over the next 5-10 years see developments in accordance with the bubble hypothesis, will those bubble-ists be willing to revisit their ideas in the light of such surprising information?

I suggest it will not be satisfactory – should this be the case – to point to new developments that could not have been known at the time of writing. For markets are forward-looking, incorporating information that could never be known to one man, and perhaps possibilities that could only be distantly imagined.

The cleanest way of deciding this would be to have a wager, but I don’t suppose this is clearly legal under US law. So I suggest we just revisit this thread in c. 3 years, and then again in 5.

In the field of investing (and we speaking here of views about the prospects of a spot market where necessarily speculative views about the future shape pricing), I have always learnt more from studying my errors, than from my successes.

Laeeth.

LikeLike

Laeeth, I am really just trying to think through the logic here, not to predict what will happen to the price of bitcoins. I am not saying that my explanation for the value of bitcoins is the correct one, just inviting people to offer a better one. I agree that it’s not satisfactory to say that the value of bitcoin must go to zero without specifying when it will go to zero. I am just pointing out what seems to me to be a problem in accounting for its value. If that puts me in the same category (with or without your dispensation) as Joe Stiglitz, I think I can live with that stigma.

I am not so sure that the end state of bitcoin is zero, I am just presenting the argument that it is zero, and inviting people to provide arguments to the contrary. You almost seem to be suggesting that owning a bitcoin is somehow analogous to having an ownership share in the bitcoin enterprise. If that’s the correct way to think about it, then perhaps that does provide a clue to why bitcoins can have a positive value. But if that’s not the case, then I think that there is still a problem.

You ask why I think demand will taper off. I think that except for a very narrow class of transactions, people have better and less costly options for media of exchange with which to effect transactions. I am guessing that a lot of the demand for bitcoins has been driven by an expectation of rising prices and that if the price drops significantly, a lot of people will try to cash out. If you think that argument is insufficiently researched and inadequately supported, you may well be right and you are free to draw the appropriate conclusions, but I don’t think that I extracted an unreasonable price from you in exchange for that argument.

Thanks for the references. I agree that if bitcoins prove to be viable and gain acceptance over an extended period of time, that will favor the Menger theory over the state theory, but it will also blast a gaping hole in Mises’s regression theorem. At any rate, I think that the key point on which we differ is that I am asserting, like Mises, that a medium of exchange must have value before it can serve as a medium of exchange, while you are saying that serving as a medium of exchange can impart value to an asset that would otherwise have no value.

Steve, Actually I am old enough to remember that the first computer I ever bought ran on a CPM operating system which everybody who knew anything about computers at the time was greatly superior to the DOS operating system sold by a little company called Microsoft. But when IBM decided to make their own desktop computer, they didn’t know enough to use CPM and instead used DOS instead and that’s how the genius Bill Gates became the world’s richest human being (at least for a while). Windows didn’t come along till later, but yeah it was inferior, too, but the idiots at IBM had already foisted the Microsoft monopoly on the rest of the world. But the analogy is not perfect. For the analogy to be perfect, you would have to assume that the DOS code was gibberish (zero real services) and that network externalities were sufficient to cause the adoption of a useless operating system. Of course my case is not really a perfect analogy either, but can you at least see why I find your analogy to be imperfect?

(Luis) Miguel, Didn’t follow your point about Austrians, but as I pointed out to

Laeeth above, even though Libertarians (who tend to be unusually susceptible to Austrian economics) seem unaware that the Bitcoins contradict Mises’s regression theorem.

JP, The question is whether if the dollar were no longer acceptable in payment of taxes there would be any remaining demand for dollars as a medium of exchange, or whether all dollars would be brought back the Fed/Treasury. The Fed/Treasury would presumably have to stipulate an exchange rate at which the dollars could be redeemed, if not – say, a Libertarian is elected President in 2016 on a platform of abolishing the Fed and repudiating all federal reserve notes– the value of outstanding federal reserve notes would go to zero.

Hoey, No I can’t make the same argument for any currency, because every paper currency provides a real service not provided by bitcoins it can be used to extinguish your tax liability to the federal government. That is a current real service provided by the currency that is independent of its value in the future. So the cases are not the same.

Lorenzo, Thanks, I will have a look.

Laeeth, I certainly concede that my reasoning is fallible, but that doesn’t mean one should not try to figure out the logical implications of one’s assumptions. It seems to me that a fairly standard set of assumptions leads to the conclusion that the value of a bitcoin should be zero. If the value of a bitcoin turns out to be sustainably positive, we shall certainly have our work cut for us to explain why it did not go to zero, and the process of figuring out what was wrong in our reasoning will be highly educational.

LikeLike

After thinking about this induction argument, I fail to see why it does not apply to other local currencies. For example, see here: http://en.wikipedia.org/wiki/Ithaca_Hours or here

http://www.berkshares.org/whatareberkshares.htm

There are hundreds. Some survive for a very long time.

The “future” in your induction argument is very hazy. Suppose my holding period is T. In a probabilistic sense, if there is a probability p that the currency will be able to be exchanged for $1 at time T, and a probability (1-p) it will be worth zero, the value ought to be $ p (minus a risk premium). Someone should be willing to transact so long as their subjective probability is higher than p.

This is similar (not exactly the same) to what the above commenter posited for option value.

With drug dealers, like most business owners, they always see themselves as going concerns. They never see themselves as going out of business. In fact, they usually see growth.

My argument boils down to: for a drug dealer, T is very very short (days, weeks), as there are millions of other people to trade with (redeem drugs for bitcoin, then sell bitcoin right away to another distributor who needs to buy, etc.). So they are not taking all that much risk. Moreover, they probably don’t see their industry going out of business anytime soon, so p~1.

There are plenty of examples of local currencies that have strong staying power, like cigarettes in prisons.

Another example: people transact in currencies that they know are depreciating all the time, they merely account for the expected loss in the forward price. My drug dealer will redeem my debt for bitcoin at $p, or in cash at $1. Depending on where I have to deliver the cash, maybe I prefer $p or $1.

Your induction argument it seems to me has the same fallacy as: “I know the Fed will raise rates to 2.25%, so why isn’t the federal funds rate 2.25% now.” Or, Zeno’s paradox.

p^t->0 eventually in the limit, like the federal funds rate eventually converges to 2.25% (see here: http://www.cmegroup.com/trading/interest-rates/stir/30-day-federal-fund.html),

But, at any finite point in time, the probability that it still exists at that point is non-zero. Bilateral trading will occur so long as two people agree on the subjective probability (which provides the appropriate depreciation rate for a forward transaction). And, since drug debts are enforced at gunpoint like taxes, currency for drug debts will have nearly the same power as fiat currency.

LikeLike

^^drug dealer will redeem my debt for bitcoin at $1/p, or in cash at $1. but you get the idea.

LikeLike

your head is a bubble. Just buy before it goes back to 1000, you will see 3500 within a year.

LikeLike

The arbitrageur, as usual, is not diplomatic.

Why Bitcoin is not in a bubble is the question of the OP.

I will try to answer (English is not my first language, so be lenient about grammar and form).

“The problem I have is that bitcoins can’t be used for anything except as a means of payment for something else.”

This is wrong.

The base for Bitcoin is solution to the Bizantine Generals problem: how to agree on something when you can not trust all the parties.

Essentially, Bitcoin is a decentralized database ordered by time and composed by blocks of transactions.

One example of a different use for it is decentralized, secure and censor resistant notary. In any transaction can be included 80 bytes of data. If I include in a transaction a cryptographic hash of a file, I can prove the file existed at some time and was in my possession (the only person with the secret key to create the transaction and the only person with a file matching the hash is me). This have also the added value to prevent unwanted publication of the content of the file, because I would just publich the hash of the file and not its actual content.

To alter the blockchain to exclude the transaction would cost millions of $, if not hundred of millions of $, depending when the deletion would happen. Immediately would cost less, after days or weeks, would cost in the order of billions of $US.

There are a lot more applications possible; the payment system and the currency are just the first app based on the blockchain technology.

If this application is useful, people could pay to obtain bitcoin and execute a transaction just to record their IP and be able to support their claims in the future.

LikeLike

“The problem I have is that bitcoins can’t be used for anything except as a means of payment for something else. Bitcoins provide no real service distinct from being a means of payment.”

Money (or currency) is defined by some characteristics: durability, divisibility, portability, scarcity, etc. Anything with these features can be used as money and whatever have the highest degree of these features is a better form of money than others with a lower degree.

Bitcoin have these characteristics defined by the design of the system: there are at most 21 millions units and any coin can be divided in 10^8 sub-units); it can be moved from the ownership of someone to the ownership of someone else without caring of the distance (because it is just an entry on a distributed DB); it can not be seized without knowing the secret key associated to the coins (you can not just kill the owners and take his gold coins or paper notes).

The Regression Theorem is, in my opinion, misunderstood by many.

Gold has no intrinsic value, like every thing have not intrinsic value – because value is not intrinsic in anything but subjective to any individual.

Gold have intrinsic characteristics making it useful as a mean of indirect exchange. These characteristics are indipendent from the characteristics giving it a direct use value (jewelery, industrial, etc.).

The point of the Regression Theorem is about the first value given to gold when it was used, for the first time, as a mean of indirect exchange. Its value for indirect exchange would be the same, the first time, as the value for direct use. When the use as a mean of indirect exchange took off, the direct use value become increasingly irrelevant.

In the case of Bitcoin, the value started from zero, because there was no real direct use value, the inflation of the supply was very large at the beginning and people didn’t know if the network would exist in a month or not.

Bitcoin started to have a monetary value around November 2009, when it was exchanged for 0.0001 $ (or 10K btc for 1 $). The market cap, at the time, was 100-200 USD. The network was around 9 months and people could be confident it would exist for some time after. More time the network exist, more people join, more improbable is someone will not find a buyer for his bitcoins. Now the network is 5 and half years old, had survived a lot of up and down, so a lot more people can be confident it will survive for many years in the future. It is remarkable it has survived without the need to force people to adopt bitcoin, so it stand on its own legs.

Bitcoin had a market cap so small, initially, we could think the initial value as the value of a single individual assigned to an experiment. Someone could have just throw 100$ at it just to see what would happen.

100$ are just a tiny quantity of noise. But in a system with a positive feedback, a tiny quantity of noise is enough to start a feedback loop.

This tiny value was enough to boostrap the entire process, because of the superiority of bitcoin over other form of money/currency in use.

As more people join, more value is transfered using the network, more powerful is the signal and more stable is the loop.

LikeLike

it’s really frustrating when supposedly smart people are too lazy to get some basis for the theories and conclusions they throw around…

Bitcoin is not like anything that has been before. so conclusions based on tulips, currencies, stocks and so on are just lazy.

a bubble is an artificial development. it’s like saying we have a car bubble based on car amounts in the early 20th century, or a internet server bubble based on the number of internet servers in 1985.

but it is actually more ridiculous. bitcoin is NOT a currency. it is a peer to peer protocol.

so in reality saying bitcoin is in a bubble is like saying we have an http bubble, or a bittorrent bubble.

bitcoin has a well known app right now: BTC

but that’s just one.

the value of bitcoin comes from its unique and unparalleled niche. a niche that is so gigantic that it could replace the majority of the financial industry, one block at a time.

it is trustless. a self regulating system that is secure and immediate.

and it is a service that anyone can use for free

so if you cannot see the value in such a system, then you’re living in a bubble. and that bubble will burst as soon as the next banking crisis arrives.

LikeLike

@interfluidity: Killed it dude.

To the author, humor me this:

Come 26 June 2017, a forward thinking country (say Switzerland) decides to accept bitcoin for tax purposes. Would Bitcoin in your eyes go from 0 value to positive value in that same one day?

Or is it the case, that both dollars and bitcoin are “valueless” in the same way?

I will write my version of why Bitcoin has value, but I need time to get it out properly.

LikeLike