Understanding economics requires, among other things, understanding the distinction between real and nominal variables. Confusion between real and nominal variables is pervasive, constantly presenting barriers to clear thinking, and snares and delusions for the mentally lazy. In this post, I want to talk about the distinction between the real rate of interest and the nominal rate of interest. That distinction has been recognized for at least a couple of centuries, Henry Thornton having mentioned it early in the nineteenth century. But the importance of the distinction wasn’t really fully understood until Irving Fisher made the distinction between the real and nominal rates of interest a key element of his theory of interest and his theory of money, expressing the relationship in algebraic form — what we now call the Fisher equation. Notation varies, but the Fisher equation can be written more or less as follows:

i = r + dP/dt,

where i is the nominal rate, r is the real rate, and dP/dt is the rate of inflation. It is important to bear in mind that the Fisher equation can be understood in two very different ways. It can either represent an ex ante relationship, with dP/dt referring to expected inflation, or it can represent an ex post relationship, with dP/dt referring to actual inflation.

What I want to discuss in this post is the tacit assumption that usually underlies our understanding, and our application, of the ex ante version of the Fisher equation. There are three distinct variables in the Fisher equation: the real and the nominal rates of interest and the rate of inflation. If we think of the Fisher equation as an ex post relationship, it holds identically, because the unobservable ex post real rate is defined as the difference between the nominal rate and the inflation rate. The ex post, or the realized, real rate has no independent existence; it is merely a semantic convention. But if we consider the more interesting interpretation of the Fisher equation as an ex ante relationship, the real interest rate, though still unobservable, is not just a semantic convention. It becomes the theoretically fundamental interest rate of capital theory — the market rate of intertemporal exchange, reflecting, as Fisher masterfully explained in his canonical renderings of the theory of capital and interest, the “fundamental” forces of time preference and the productivity of capital. Because it is determined by economic “fundamentals,” economists of a certain mindset naturally assume that the real interest rate is independent of monetary forces, except insofar as monetary factors are incorporated in inflation expectations. But if money is neutral, at least in the long run, then the real rate has to be independent of monetary factors, at least in the long run. So in most expositions of the Fisher equation, it is tacitly assumed that the real rate can be treated as a parameter determined, outside the model, by the “fundamentals.” With r determined exogenously, fluctuations in i are correlated with, and reflect, changes in expected inflation.

Now there’s an obvious problem with the Fisher equation, which is that in many, if not most, monetary models, going back to Thornton and Wicksell in the nineteenth century, and to Hawtrey and Keynes in the twentieth, and in today’s modern New Keynesian models, it is precisely by way of changes in its lending rate to the banking system that the central bank controls the rate of inflation. And in this framework, the nominal interest rate is negatively correlated with inflation, not positively correlated, as implied by the usual understanding of the Fisher equation. Raising the nominal interest rate reduces inflation, and reducing the nominal interest rate raises inflation. The conventional resolution of this anomaly is that the change in the nominal interest rate is just temporary, so that, after the economy adjusts to the policy of the central bank, the nominal interest rate also adjusts to a level consistent with the exogenous real rate and to the rate of inflation implied by the policy of the central bank. The Fisher equation is thus an equilibrium relationship, while central-bank policy operates by creating a short-term disequilibrium. But the short-term disequilibrium imposed by the central bank cannot be sustained, because the economy inevitably begins an adjustment process that restores the equilibrium real interest rate, a rate determined by fundamental forces that eventually override any nominal interest rate set by the central bank if that rate is inconsistent with the equilibrium real interest rate and the expected rate of inflation.

It was just this analogy between the powerlessness of the central bank to hold the nominal interest rate below the sum of the exogenously determined equilibrium real rate and the expected rate of inflation that led Milton Friedman to the idea of a “natural rate of unemployment” when he argued that monetary policy could not keep the unemployment rate below the “natural rate ground out by the Walrasian system of general equilibrium equations.” Having been used by Wicksell as a synonym for the Fisherian equilibrium real rate, the term “natural rate” was undoubtedly adopted by Friedman, because monetarily induced deviations between the actual rate of unemployment and the natural rate of unemployment set in motion an adjustment process that restores unemployment to its “natural” level, just as any deviation between the nominal interest rate and the sum of the equilibrium real rate and expected inflation triggers an adjustment process that restores equality between the nominal rate and the sum of the equilibrium real rate and expected inflation.

So, if the ability of the central bank to use its power over the nominal rate to control the real rate of interest is as limited as the conventional interpretation of the Fisher equation suggests, here’s my question: When critics of monetary stimulus accuse the Fed of rigging interest rates, using the Fed’s power to keep interest rates “artificially low,” taking bread out of the mouths of widows, orphans and millionaires, what exactly are they talking about? The Fed has no legal power to set interest rates; it can only announce what interest rate it will lend at, and it can buy and sell assets in the market. It has an advantage because it can create the money with which to buy assets. But if you believe that the Fed cannot reduce the rate of unemployment below the “natural rate of unemployment” by printing money, why would you believe that the Fed can reduce the real rate of interest below the “natural rate of interest” by printing money? Martin Feldstein and the Wall Street Journal believe that the Fed is unable to do one, but perfectly able to do the other. Sorry, but I just don’t get it.

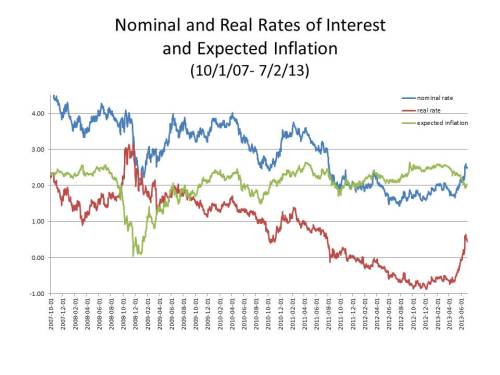

Look at the accompanying chart. It tracks the three variables in the Fisher equation (the nominal interest rate, the real interest rate, and expected inflation) from October 1, 2007 to July 2, 2013. To measure the nominal interest rate, I use the yield on 10-year Treasury bonds; to measure the real interest rate, I use the yield on 10-year TIPS; to measure expected inflation, I use the 10-year breakeven TIPS spread. The yield on the 10-year TIPS is an imperfect measure of the real rate, and the 10-year TIPS spread is an imperfect measure of inflation expectations, especially during financial crises, when the rates on TIPS are distorted by illiquidity in the TIPS market. Those aren’t the only problems with identifying the TIPS yield with the real rate and the TIPS spread with inflation expectations, but those variables usually do provide a decent approximation of what is happening to real rates and to inflation expectations over time.

Before getting to the main point, I want to make a couple of preliminary observations about the behavior of the real rate over time. First, notice that the real rate declined steadily, with a few small blips, from October 2007 to March 2008, when the Fed was reducing the Fed Funds target rate from 4.75 to 3% as the economy was sliding into a recession that officially began in December 2007. The Fed reduced the Fed Funds target to 2% at the end of April, but real interest rates had already started climbing in early March, so the failure of the FOMC to reduce the Fed Funds target again till October 2008, three weeks after the onset of the financial crisis, clearly meant that there was at least a passive tightening of monetary policy throughout the second and third quarters, helping create the conditions that precipitated the crisis in September. The rapid reduction in the Fed Funds target from 2% in October to 0.25% in December 2008 brought real interest rates down, but, despite the low Fed Funds rate, a lack of liquidity caused a severe tightening of monetary conditions in early 2009, forcing real interest rates to rise sharply until the Fed announced its first QE program in March 2009.

I won’t go into more detail about ups and downs in the real rate since March 2009. Let’s just focus on the overall trend. From that time forward, what we see is a steady decline in real interest rates from over 2% at the start of the initial QE program till real rates bottomed out in early 2012 at just over -1%. So, over a period of three years, there was a steady 3% decline in real interest rates. This was no temporary phenomenon; it was a sustained trend. I have yet to hear anyone explain how the Fed could have single-handedly produced a steady downward trend in real interest rates by way of monetary expansion over a period of three years. To claim that decline in real interest rates was caused by monetary expansion on the part of the Fed flatly contradicts everything that we think we know about the determination of real interest rates. Maybe what we think we know is all wrong. But if it is, people who blame the Fed for a three-year decline in real interest rates that few reputable economists – and certainly no economists that Fed critics pay any attention to — ever thought was achievable by monetary policy ought to provide an explanation for how the Fed suddenly got new and unimagined powers to determine real interest rates. Until they come forward with such an explanation, Fed critics have a major credibility problem.

So please – please — Wall Street Journal editorial page, Martin Feldstein, John Taylor, et al., enlighten us. We’re waiting.

PS Of course, there is a perfectly obvious explanation for the three-year long decline in real interest rates, but not one very attractive to critics of QE. Either the equilibrium real interest rate has been falling since 2009, or the equilibrium real interest rate fell before 2009, but nominal rates adjusted slowly to the reduced real rate. The real interest rate might have adjusted more rapidly to the reduced equilibrium rate, but that would have required expected inflation to have risen. What that means is that sometimes it is the real interest rate, not, as is usually assumed, the nominal rate, that adjusts to the expected rate of inflation. My next post will discuss that alternative understanding of the implicit dynamics of the Fisher equation.

I seriously doubt this is true. Rogoff & Reinhart have observed that the US government employed financial repression after WWII, and further, that FR utilized the power of the central bank to suppress artificially the real rate of interest. The Fed did this via Reg Q and by keeping the short term rates below the rate of inflation. The fact is, it worked, and this was not a mere theory, it paid off the entire WWII war debt. So yes, the Fed can suppress the real rate, and in fact, has done so many times.

LikeLike

I was reading a paper by Hoffman and Urbanksy “Order, displacements and recurring financial crises” when I came across this statement:

“Because the growing financial markets absorbed much liquidity, inflation rates remained stable since the 1990s despite a downward trend in real and nominal interest rates” (p.15). Having read your enlightening post, I am even more puzzled by their statement than when I first read (and re-read) it. Surely, if both nominal and real interest rates are declining at similar rates, that rather requires inflation rates to be fairly steady? See your graph.

Is the confusion over interest rates that Scott Sumner regularly complains about (that low interest rates are generally a sign that money has been relatively tight, high interest rates that it has been relatively loose), even though cutting rates generally represents an easing of monetary policy, at work here? I.e. is confusion between the difference between a change and a level operating here.

LikeLike

David Glasner,

Excellent post. The Fisher Equation is such a simple idea yet so essential to properly understanding monetary economics.

LikeLike

I think part of the source of confusion is a poor choice of notation. The expression

i = r + dP/dt

implies that there is a variable P of which you are taking a time derivative. In the ex facto version of the equation, this clearly correct. As you say, the equation is a definition of the real rate of interest and has no possibility of ever not holding.

In the ex ante version, it should be replaced by

i = r_e + I_e

where r_e is the expected real rate of interest and I_e is the expected real rate of interest. Note that i is, as before, a directly observable quantity and isn’t any sort of expectation. This equation too is a tautology, however it is underdetermined – how do we determine how to separate i into r_e and I_e?

There is another measure you use in this way: the difference between an inflation protected interest rate and the non-inflation-protected rate:

I_e = i – i_p

which, plugging into the previous equation means

r_e = i_p

This allows us to determine all the quantities, but is certainly not very interesting.

What you’re saying is that there is an economic “hidden variable”, which is the true real rate of interest, which we can call r, but that may or may not at any time be equal to the actual real rate of interest. (The latter may be perhaps be determined for example by looking at the return on capital in competitive markets.)

Presumably there is a time lag in equilibrating r with r_e, but, one would expect, in the long run, this equation would hold as well.

LikeLike

Oops. I_e is the expected rate of inflation, obviously,

LikeLike

David,

“But if you believe that the Fed cannot reduce the rate of unemployment below the natural rate of unemployment by printing money, why would you believe that the Fed can reduce the real rate of interest below the natural rate of interest by printing money?”

Because you believe that by lowering the nominal market interest rate on existing debt, you can entice consumption in excess of production funded with new debt. In short, you are betting on a continued decline in U. S. productivity:

http://research.stlouisfed.org/fred2/graph/fredgraph.pdf?&chart_type=line&graph_id=&category_id=&recession_bars=On&width=630&height=378&bgcolor=%23b3cde7&graph_bgcolor=%23ffffff&txtcolor=%23000000&ts=8&preserve_ratio=true&fo=ve&id=GDPC1_TCMDO&transformation=lin_lin&scale=Left&range=Custom&cosd=1950-01-01&coed=2013-01-01&line_color=%230000ff&link_values=&mark_type=NONE&mw=4&line_style=Solid&lw=1&vintage_date=2013-07-05_2013-07-05&revision_date=2013-07-05_2013-07-05&mma=0&nd=_&ost=&oet=&fml=a%2Fb&fq=Quarterly&fam=avg&fgst=lin

And it’s not as if that bet has swung positive over the last 60 years.

LikeLike

David,

The Fed cannot control real variables in the economy. Like unemployment.

The Fed can control nominal variables. Two of these are the s.t. interest rate and inflation. The combination of both yields the s.t. real interest rate. Thus, the Fed determines the s.t. real rate.

Whether, or how, the Fed controls the l.t. interest rate is a matter of debate. Some argue it does so by adjusting the expected path of the s.t. rate, but the influence of this is likely slight beyond five years or so.

Others claim QE influences the term nominal rate via the portfolio balances effect. Woodford has his doubts, and they are good ones.

People like me claim QE influences term nominal rates due to financial frictions: agency effects that incentivize speculative strategies such as carry and frontrunning. These allow the Fed to temporarily influence term rates. Of course, if the Fed can control inflation expectations and influence term rates, then it influences the term real yield.

Of these explanations, the only one that accounts for the performance of all asset classes since 2009 is the last one. The other explanations for declining real rates are incompatible with rising stock prices.

LikeLike

“the real interest rate, though still unobservable”

The gold lease rate could be called a real interest rate, along with a lot of other real rates that are set when people borrow a commodity and pay interest in that commodity. A composite of these commodity interest rates would be very close to a true real interest rate.

LikeLike

Thought: We have a globalized economy, capital moves across borders by keypunch. Plus there is a couple trillion in cash floating around globally, all denominations.

And the Fed is setting long-term interest rates? Really?

LikeLike

Mr. Glasner,

I am not an economist.

It seems to me when I see austrian/hard-money-types refer to the idea that the FED is holding nominal interest rates “artificially low” and below some “natural rate of interest” it seems to me that they must not be considering the “Real Interest Rate” as we might delineate from the Fisher Equation, to be the “Real Interest Rate”.

As your graph shows, the “Real Interest Rate” for the last several years has been apparently been negative. However, during this time, hard-money types have nevertheless argued that the FED is holding rates below their “natural rate”

I’ve seen this in various commentary at Forbes, CNBC, Twitter, etc.

Upon what foundation might these folks be grounding their idea of what the “natural interest rate”???

LikeLike

For clarification,

It often seems like Austrian/Hard-Money Types act like the FED is artificially holding nominal rates lower than some natural rate of interest…but per the Fisher Equation it seems like the Real Interest Rate is often lower than the nominal rate. Where are they getting this?

LikeLike

This is only a paradox if you believe that central banks really do have the ability to always control the rate of inflation. Fisher’s theory is based on the notion that inflation is endogenous which seems to account for some of the current misunderstanding of the problem.

Mankiw’s comment in 2006 that inflation fell in those countries that targeted inflation as well as in those countries that didn’t target inflation highlights the issue presciently. This is not to argue that under certain conditions central banks cant influence the rate of inflation (Volcker in early 1980’s), but rather that there are other dynamics at work in the system that central banks cant control such as exogenous productivity shocks.

I think the comments of Leijonhufvud in Information and Coordination have remained ignored for too long. (This book was recently on David Laidler’s top monetary economics books to read)

“The first thing to say, surely, is that we know very little about how inflations work their way through the economy. Our empirical knowledge is scant.”

LikeLike

Your explanation of the fall in the real rate holds water. But it’s strange that a repricing of real rates for a US-as-Japan scenario would not also be associated with falling inflation expectations – a US-as-Japan scenario with 2% expected inflation.

The episodes of steeply falling inflation expectations that preceded QEs 1 & 2 and Op Twist were associated with steep declines in real rates; both markets repriced for a US-as-Japan scenario. QEs 1 & 2 and Op Twist reversed the declines in inflation expectations. The puzzle is the hysteresis in real rates. I attribute it to stop-go monetary policy; the pre-QE3 unconventional easings were seen as transitory interruptions on the path to a US-as-Japan scenario.

QE3 ended stop-go (even if it didn’t eliminate discretion) and real rates are normalizing.

LikeLike

First, I think that you misuse the world “neutrality” here. Everybody knows that bad government policy (including bad monetary policy) can have adverse impact on real variables like unemployment and real interest rates.

If we start with an assumption that Monetary Policy has impact on real variables short term, then we know that it will also have impact long-term : because as Paul Krugman says “long-term is just a series of short-term”

So this is the key part of your post which I thinks is true:

“But the short-term disequilibrium imposed by the central bank cannot be sustained, because the economy inevitably begins an adjustment process that restores the equilibrium real interest rate, a rate determined by fundamental forces that eventually override any nominal interest rate set by the central bank if that rate is inconsistent with the equilibrium real interest rate and the expected rate of inflation.”

… only sometimes bad Monetary policy has real impacts – for instance it reduces the real interest rate – which means no “overriding” of nominal interest rate set by central bank by “fundamental forces” – or to be more precise, central bank is large part of these fundamental forces.

LikeLike

maynardGkeynes, I was not talking about what the Fed did years ago, I am talking about what it is doing now. Regulation Q no longer exists. What is the “financial repression” that is now being exercised by the Fed?

Lorenzo, Yes, that is certainly part of it. One has to look at the central bank’s target rate relative to the market’s expectations of future rates

W. Peden, Thanks, I agree that the Fisher equation is essential. It is at least as important as MV=PQ.

Mitch, I’m not sure if your problem with notation is with mine in this post or with the notation of the Fisher equation in general. I agree that, given the nominal rate of interest, there is nothing in the Fisher equation that determines how to divide the nominal rate between a real rate and an inflation rate. That’s why I pointed out that the common practice of many economists is to assume that the real rate is determined by “fundamentals.” That, I believe, is a workable approach only under special circumstances. In other words, if monetary policy affects inflation expectations, there is no guarantee that it will not also affect the real rate of interest.

Frank, So, let me understand. Are you saying that “you believe that you can entice consumption in excess of production funded with new debt,” and that “you believe that the Fed cannot reduce the rate of unemployment below the natural rate of unemployment?” I also can’t tell what is being measured in the graph that you link to.

Diego, Following your reasoning, couldn’t one say that the Fed can control nominal GDP and the price level. The combination of both yields real GDP, and real GDP determines (un)employment. So the Fed can control unemployment.

I maintain that the Fed can control the short-term nominal rate only because the short-term real rate is negative. If the real rate were not negative, the Fed could not enforce a zero short-term nominal rate, because the rate of inflation and inflation expectations would quickly rise. I don’t dispute that there may be financial frictions such as you describe, but I think those effects are second-order. But having said all that, if you or someone else has a discussion showing that financial frictions provide the only explanation accounting for the performance of all asset classes since 2009, I would very much like to see it. In the meantime could you explain – an I apologize if I am asking you to repeat yourself – why declining real rates are incompatible with rising stock prices?

Mike, Where could I go to look at the gold lease rate?

Benjamin, Nicely put.

Cory, Some of my best friends are not economists.

You are asking exactly the question to which I am seeking an answer. I think that there may be an implicit assumption that there is a kind of natural or praxeological law that interest rates are necessarily positive. I think that Mises in Human Action tried to provide a proof that the “originary rate of interest” (never understood the meaning of the adjective) has to be positive. Of course what constitutes a “proof” for Mises would not necessarily constitute a proof for ordinary mortals. Based on my reading of Mises, a proof was essentially any belief of his for which he could provide some sort of minimally plausible argument. So for hard-core Austrians, it would simply be a non-starter to entertain the possibility that there could be a negative real interest rate, because that would contradict a theorem “proved” by von Mises. A zero nominal rate could therefore only be achieved by means of interference with the free market which, based on the theorem “proved” by von Mises, would never allow the real rate of interest to be negative.

Tom, On what do you base your assertion that Fisher’s theory is based on the notion that inflation is endogenous? I agree that inflation in any country is influenced by both internal and external factors, but that doesn’t mean that the monetary authority in any country could not, within some range, control the rate of inflation in that country. I do agree that Leijonhufvud’s book is superb, and deserves to be read more widely than it has been.

LikeLike

@ David: Short term rates have been below the rate of inflation for some time now, which is precisely the state of affairs the Fed has sought to bring about. I call that Financial Repression. Perhaps you are arguing that they would be that low anyway, but that is not what the Fed believes is the case, and I am inclined to take them at their word.

LikeLike

David:

Here’s a link for gold lease rates.

http://www.kitco.com/lease.chart.html

JP Koning also had some interesting stuff to say about the gold lease rate over at his ‘moneyness’ blog.

LikeLike

Your explanation of the fall in the real rate holds water. But it’s strange that a repricing of real rates for a US-as-Japan scenario would not also be associated with falling inflation expectations – a US-as-Japan scenario with 2% expected inflation.

The episodes of steeply falling inflation expectations that preceded QEs 1 & 2 and Op Twist were associated with steep declines in real rates; both markets repriced for a US-as-Japan scenario. QEs 1 & 2 and Op Twist reversed the declines in inflation expectations. The puzzle is the hysteresis in real rates. I attribute it to stop-go monetary policy; the pre-QE3 unconventional easings were seen as transitory interruptions on the path to a US-as-Japan scenario.

QE3 ended stop-go (even if it didn’t eliminate discretion) and real rates are normalizing.

LikeLike

David,

In Purchasing Power of Money, chapter 6 Fisher argues that although the international and interlocal equilibrium of prices may be disturbed by differential changes in the volume of money..equilibrium will eventually be restored through an international and interlocal redistribution of money and goods. (p,95) In essence, imported inflation would lead to falling demand leading to lower investment and a fall in prices. Ie exogenous factors can only have a short term impact on the economy but no long term impact. I would argue that the integration of China and India into the economy had a long term impact on the US economy to the extent that the credit bubble was noninflationary. Fisher’s theory of business cycles argued that excess credit (money) growth would lead to rising inflation – which rarely happens in credit bubbles (US in 1920s, Japan 1980s US in 2000s)

LikeLike

An endogenous view of prices also comes through in Fishers’ 1926 article, a statistical relationship between unemployment and prices changes which is the same basis for the Phillips Curve. This Ed Nelson paper on endogenous views of prices is useful.

Click to access Nelson.pdf

Interestingly if you take a closer look at Phillips data set, the relationship breaks down when inflation and deflation is imported – something that was conveniently forgotten. Phillips accepted the case for imported inflation and tried to argue that the relationship didnt work in the 1870’s because of a data anomaly caused by n index calculation. But this was bang in the middle of a period of falling prices in the UK.

LikeLike

David,

Your question: “Why would you believe that the Fed can reduce the real rate of interest below the natural rate of interest by printing money?”

My answer: “Because you believe that by lowering the nominal market interest rate on existing debt, you can entice consumption in excess of production funded with new debt.”

Your question: “Are you saying that you believe that you can entice consumption in excess of production funded with new debt?”.

Let me amend my previous answer:

I am saying that if you believe that the Fed can reduce the real rate of interest below the “natural rate”, then you believe that the Fed can entice consumption in excess of production by lowering the nominal market rate of interest on existing debt.

LikeLike

maynardGkeynes, What I am suggesting is that if the Fed can drive down the real rate of interest, it’s only because the underlying conditions in the economy allow it to fall to that level. If the economy wree at full employment and the Fed tried to drive the real interest rate below zero, a real reaction would set in that would frustrate the Fed’s attempt. If the Fed is succeeding it’s only because the real economy can tolerate such a low rate. A normally functioning economy would not tolerate such a low rate.

Mike, Sorry, but I need help making sense of the different graphs on the link that you sent me. But I think that I get the basic idea.

Tim, QE3 started last fall, the rise in real rates only began in the spring. How do you account for that?

Tom, I don’t get how imported inflation leads to falling demand and falling prices. I also don’t think that I really understand what you mean when you say that inflation is endogenous.

Frank, Sorry, but I am now hopelessly confused.

LikeLike

David, I surmise that the “real reaction” you are alluding to would be CPI inflation. However, the form that inflation takes in an economy where wealth and income distribution are so skewed toward the top is not traditional CPI inflation, but inflated asset prices, which is what we are seeing. One can debate why that form of “inflation” is so well tolerated by the economy, despite its distortionary effects, but I suspect it has a lot to do with who has benefited by it, namely, the people who own the inflated assets, who tend to be relatively (and in most cases absolutely) well-off, and who are now even betterl-off than before.

LikeLike

David,

Before QE3 risk-on, risk-off was the “right” way to think about financial markets. Correlations among risky assets were high because of the single source of volatility, US monetary policy. That changed with QE3. The correlations broke down. It took people time to appreciate the implications of well-supported inflation expectations.

LikeLike

David, if you see the section “THE POWER AND DUTY OF

MONETARY POLICY” in the Ed Nelson paper, he states that Friedman argues that exogenous price shocks can only have transitory effects that hardly matter for expectations.

“The Friedman framework rejects the notion that shocks to specific prices can in themselves be a source of ongoing inflation. If these shocks are associated with a change in the mean of inflation, it is because the monetary authority’s reaction to the shock has had the effect of shifting the mean of inflation. This position on the power of monetary policy is also that adhered to by Taylor,31 as discussed above, and shows up clearly also in policy discussions such as that of Mishkin (2007).”

So I think the more interesting question is therefore to what extent was Fed policy driving the roughly constant 2% inflation expectations versus exogenous factors? Friedman and Taylor discount exogenous factors but I am less convinced that the bond market ignores exogenous factors. Philips’ work here is I think interesting.

Re: export and import of inflation, see p.92 on Connecticut. My interpretation is that this is his long term view of a tendency towards monetary equilibrium where international and interlocal trade will produce an adjustment of price levels towards uniformity.

LikeLike

David, I wrote a bit about gold lease rates here:

http://jpkoning.blogspot.ca/2012/11/what-golds-negative-lease-rate-teaches.html

One aspect of the above conversation I always find so difficult to follow is the use of several words for the same idea. Natural rate and real rate, for instance, are often used interchangeably.

Splendid post, although I’m a few weeks late reading it.

LikeLike

JP,

“One aspect of the above conversation I always find so difficult to follow is the use of several words for the same idea. Natural rate and real rate, for instance, are often used interchangeably.”

The best way to think of it is this:

Nominal Interest Rate (Money Rate) = Inflation Rate + Real Interest Rate (Real economic growth rate) + Default Premium

Natural Interest Rate = Inflation Rate + Real Interest Rate

The credit markets are not homogenous.

LikeLike

Frank, is this Fisher’s definition of the natural rate of interest? If so, could you send me the reference? I’m interested in general where this kind of confusion arises in the history of economics. There is a large body of thought from Bohm Bawerk through to Wicksell, Hayek, Myrdal and to an extent Keynes (although he is more careless in his terminology) that argues that the natural rate of interest is the income returned to the owners of capital determined by the marginal productivity of that capital.

LikeLike

JP: Your definition of nominal rates is not standard parlance. This is particularly true in the case where it matters, TIPS vs. Nominal Treasuries, i.e, riskless rates. The spread is accounted for entirely by inflationary expectations, with slight distortions caused by liquidity and IR uncertainty premia.

LikeLike

maynardGkeynes, CPI inflation is not the real reaction that I have in mind, but it is a likely result of the real reaction. It is not clear to me why only economies with evenly distributed income are vulnerable to inflation, but I have to admit that I haven’t studied models in which income distribution is a critical to macrodynamics, so I may be missing something.

Tim, Why do you assume that QE3 is the cause of riskiness rather than some other feature(s) of the underlying economic situation or some other element of policy?

Tom, It seems to me that what Nelson and Friedman mean by exogenous price shocks is a shock to a particular price, e.g., an oil price shock, which would only have transitory price level effects unless monetary policy was used to nullify the price shock by imposing a price level change to restore the pre-shock real price of the affected commodity.

The question then is does the market anticipate that monetary policy will accommodate a real price shock or will remain committed to a particular price level or inflation path. I don’t see a page 92 in the PDF you linked to.

JP, Thanks for the kind words and for the link. The way I think about it is that the real rate is simply the nominal rate adjusted for some measure of inflation. The natural rate, as it has been used since Wicksell, involves some notion of equilibrium. Thus, to the extent that the Fisher equation is an equilibrium relation (which is the more interesting way to think about it, otherwise it’s just an accounting identity), it is implicitly identifying the real rate with the natural rate. However, there is still Keynes’s view that the equilibrium real rate is a function of the level of employment and different real rates correspond to different levels of employment (though Keynes didn’t work out the relationship, a major gap in his exposition). That’s not an exhaustive taxonomy, but it gives you some idea of the way you could make the relevant distinctions.

Frank and Tom, That is certainly one way to distinguish between the real and the natural rate, but I don’t think that your distinction would reflect the usage of the terms in the economics literature.

maynardGkeynes, I think you mean to respond to Frank not to JP.

LikeLike

David, the reference was to Fisher, Purchasing Power of Money (Chapter VI). Not sure if the page numbers are the same for different editions though!

I agree that there is a great deal of divergence between many modern economists’ terminology of the natural rate (largely influenced by Friedman) versus Wicksell’s initial description of the natural rate. In chapter 8 of Interest and Prices, Wicksell defines it as the “natural rate of interest on capital”. Wicksell stated that the data required to calculate the natural rate on capital could be extracted from company accounts. In essence, Wicksell’s theory is a macro one based on micro foundations.

Wicksell’s definition was central to the Stockholm School’s view as well as Hayek. It’s interesting that Leijonhufvud describes in Information and Coordination how Wicksell’s theories also influenced Robertson and the great Hawtrey himself. Of note is that Fisher and Friedman remained outside his sphere if influence. (So the divergence should not be that surprising) Chapter 4 of my recent book discusses this in quite a lot of detail if you are interested.

LikeLike

Tim, Why do you assume that QE3 is the cause of riskiness rather than some other feature(s) of the underlying economic situation or some other element of policy?

David, This may be a failure of imagination on my part but QE3 is the only thing I can think of that explains the breakdown of Risk-on, Risk-off after the third quarter of 2012. The breakdown seems obvious to me from the quarterly performance of broad asset classes — developed market equities, emerging market equities, emerging market US$ credit, the US$, gold and US Treasuries.

LikeLike

maynardGKeynes,

“This is particularly true in the case where it matters, TIPS vs. Nominal Treasuries, i.e, riskless rates.”

You are forgetting about early repayment risk. Do the interest rates on government securities take into account the possibility of early repayment (budget surpluses)? Technically, this is a default and can create some real problems for entities trying to match the duration of its assets (government bonds) with the duration of liabilities (pension / retirement funds).

The money rate of interest is the interest rate received by the lender, not the stated interest rate on the loan. The default premium can be positive or negative.

And so, with regard to TIPs versus nominal treasuries – if a government decides to run a surplus which securities are retired early and do the interest rates on those securities adequately reflect the potential for early retirement?

LikeLike

@Frank: Not sure I follow. Since 1985, US Treasury bonds have been non-callable. There is no early payback risk as far as I know.

LikeLike

maynardGkeynes,

“Not sure I follow. Since 1985, US Treasury bonds have been non-callable. There is no early payback risk as far as I know.”

First, the only point that I was making is that the nominal interest rate must be adjusted by the default premium for two cases:

Lender receives money interest greater than the natural rate

Lender receives money interest less than the natural rate

On U. S. Treasury bonds, I understand that the U. S. has not issued any since 1985 which leaves me wonder if there are any 1984 vintage 30 year callable bonds floating around out there.

Also, does the non-call feature of U. S. Treasury securities hold up under international law? Domestically a bank / pension fund / etc. could conceivably sue the federal government for breach of contract if it tries to buy back its debt before maturity. Can the same thing be said of international holdings?

What I am getting at is just because a government says it won’t do something does not mean that it really won’t.

LikeLike

David,

Do you think that the source of confusion is either deliberate attempt to ignore or lack of realization of the fact that (by the WSJ contributors you refer to), as you notice, the Fed has so much power right now precisely because the real interest rate is below 0 and that things get a bit different? If so do you think it is just a part of a larger narrative and this is just a convenient opportunity to advance it?

LikeLike

Ilya, My own view about your question is purely uninformed speculation, so there is really no point in sharing it. But since you ask, I will just say that the arguments I am criticizing seem to me to be motivated largely by political opportunism. People tend to reach for whatever arguments will work for them at the moment regardless of whether the arguments are consistent with other positions or arguments they have taken in the past. That’s just the way people are.

LikeLike