Robert Waldmann is unhappy with Matthew Yglesias for being hopeful that, Shinzo Abe, just elected prime minister of Japan, may be about to make an important contribution to the world economy, and to economic science, by prodding the Bank of Japan to increase its inflation target and by insisting that the BOJ actually hit the new target. Since I don’t regularly read Waldmann’s blog (not because it’s not worth reading — I usually enjoy reading it when I get to it – I just can’t keep up with that many blogs), I’m not sure why Waldmann finds Yglesias’s piece so annoying. OK, Waldmann’s a Keynesian and prefers fiscal to monetary policy, but so is Paul Krugman, and he thinks that monetary policy can be effective even at the zero lower bound. At any rate this is how Waldmann responds to Yglesias:

Ben Bernanke too has declared a policy of unlimited quantitative easing and increased inflation (new target only 2.5% but that’s higher than current inflation). The declaration (which was a surprise) had essentially no effect on prices for medium term treasuries, TIPS or the breakeven.

I was wondering when you would comment, since you have confidently asserted again and again that if only the FOMC did what it just did, expected inflation would jump and then GDP growth would increase.

However, instead of noting the utter total failure of your past predictions (and the perfect confirmation of mine) you just boldly make new predictions.

Face fact, like conventional monetary policy (in the US the Federal Funds rate) forward guidance is pedal to the metal. It’s long past time for you to start climbing down.

I mention this, because just yesterday I happened across another blog post about what Bernanke said after the FOMC meeting. This post by David Altig, executive VP and research director of the Atlanta Fed, was on the macroblog. Altig points out that, despite the increase in the Fed’s inflation threshold from 2 to 2.5%, the Fed increased neither its inflation target (still 2%) nor its inflation forecast (still under 2%). All that the Fed did was to say that it won’t immediately slam on the brakes if inflation rises above 2% provided that unemployment is greater than 6.5% and inflation is less than 2.5%. That seems like a pretty marginal change in policy to me.

Also have a look at this post from earlier today by Yglesias, showing that the Japanese stock market has risen about 5.5% in the last two weeks, and about 2% in the two days since Abe’s election. Here is Yglesias’s chart showing the rise of the Nikkei over the past two weeks.

In addition, here is a news story from Bloomberg about rising yields on Japanese government bonds, which are now the highest since April.

Japan‘s bonds declined, sending 20- year yields to an eight-month high, as demand ebbed at a sale of the securities and domestic shares climbed.

The sale of 1.2 trillion yen ($14.3 billion) of 20-year bonds had the lowest demand in four months. Yields on the benchmark 10-year note rose to a one-month high as Japan’s Nikkei 225 Stock Average reached the most since April amid signs U.S. budget talks are progressing.

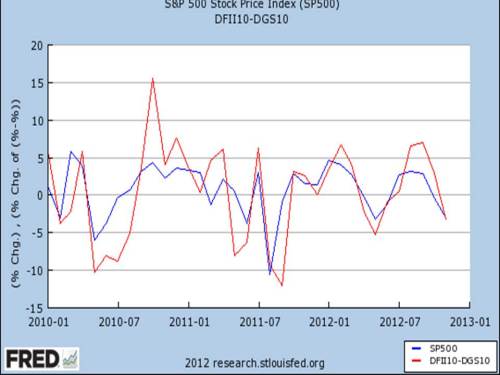

Finally, another item from Yglesias, a nice little graph showing the continuing close relationship between the S&P 500 and inflation expectations as approximated by the breakeven TIPS spread on 10-year Treasuries, a relationship for which I have provided (in a paper available here) a theoretical explanation as well as statistical evidence that the relationship did not begin to be observed until approximately the spring of 2008 as the US economy, even before the Lehman debacle, began its steep contraction. Here’s the graph.

HT: Mark Thoma

UPDATE: Added a link above to the blog post by Altig about what Bernanke meant when he announced a 2.5% inflation threshold.

David

Yes, Waldmann got heated up for nothing. Bernanke just took another one of his “baby steps”. As Mark Carney said in his speech, forward guidance-cum-thresholds is the “end of the line”. After that, only a change in framework (hopefully towards NGDP-LT) and that requires a change in command. So in January 2014, its bye-bye, Bernanke.

LikeLike

I am firmly in the Market Monetarist camp, I believe in aggressive Qe and telling everybody who will listen that aggressive QE will be maintained until we are eating money because its cheaper than spinach.

Okay, I exaggerate a bit, but my main point is that I wonder if in any Western democracy any government agency, including central banks, have any credibility.

1. No one knows who are central bankers. You think 1 in 50 Americans could pick Bernanke out of a line-up of NBA All-Stars? They do not know what Bernanke is saying, or not saying, and they don’t care.

2. Even if the public came to know Bernanke, they would not believe him, or any government official. Skepticism, cynicism, dubiousness rules the day. It does not help that both parties and every administration seems to lie constantly to the American people. So now we will believe central bankers?

All that said, if the Fed sustained serious QE, sooner or later bond holders will have to do something with their dough. That, or we can pay down the national debt to zero.

Side question to David: Lately some bloggers are saying QE does not create money, just alters Fed liabilities. One blogger even said the Fed borrows money to conduct QE.

Could you say something about this?

LikeLike

Thanks for the link and commentary. I notice it is not of the form “I beg to differ why my esteemed fellow blogger Robert Waldmann”: It might be the alarmingly august image of R.G. Hawtrey, but after reading this post, I had a nightmare last night in which the blogosphere or maybe the economics profession (it wasn’t clear) scolded me for confidently commenting on Abe without looking at the evidence. The stern correction was administered sort of by you but with Hawtrey’s face.

LikeLike

Robert, Sorry for the lapse in etiquette, especially since it’s hard to imagine Sir Ralph ever having such a lapse. Also, sorry for triggering a bad dream. And finally, don’t worry, all is forgiven.

LikeLike

David, The Japanese rally is actually much bigger. The nikkei was at about 8650 in mid-november, right before Abe’s call for a 2% inflation target sent it soaring.

LikeLike

Marcus, Yes, perhaps Bernanke’s contribution is to prepare the ground for the fundamental changes that his successor will institute. Maybe that’s the optimistic spin on what he has accomplished.

Benjamin, Yes there is a credibility problem, and unfortunately it is affecting all our institutions. Can you give me some links or references. In an accounting sense, the creation of money by the Fed corresponds to an increase in its liabilities. I am not sure why that is regarded as highly significant. I don’t know what is meant by borrowing money to conduct QE, I would have to see the entire statement before I could respond.

Scott, Thanks for that info, which I was vaguely aware of, but I was just channeling Yglesias. Abe’s election haduring the s been anticipated for a long time, so there is little question that the effect of the policy on stock prices is greater than the run-up in the last two weeks. But the longer the time period, the harder it is to attribute the entire effect to a single cause.

LikeLike

Japan is going down big time. If I had money, I would short Japan in just about everything that you can. The country is a ticking time bomb just waiting to explode.

LikeLike